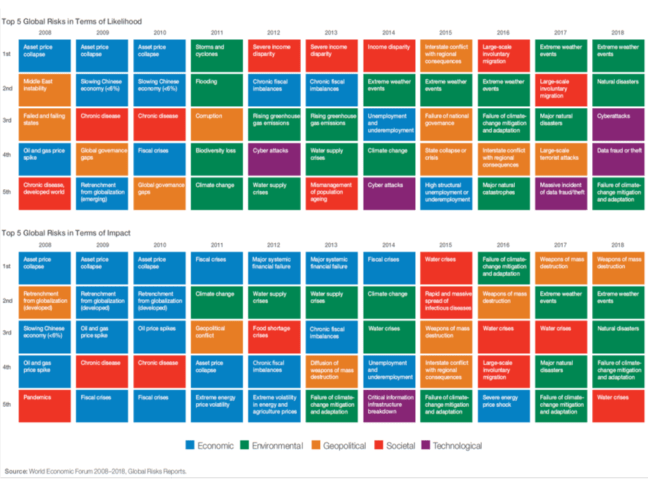

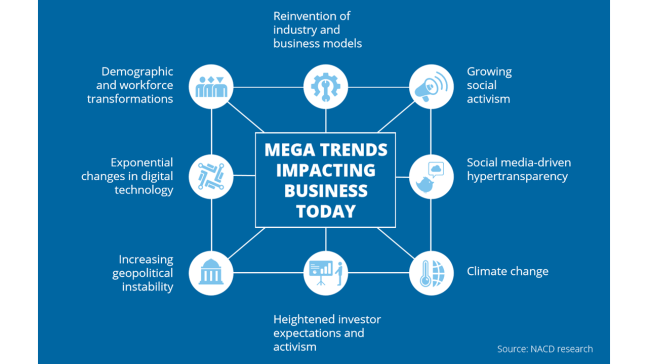

It is a truism that the only constant in business is change. But that statement does not remotely do justice to the scale and scope of the multiple changes confronting business in the first half of the twenty-first century:

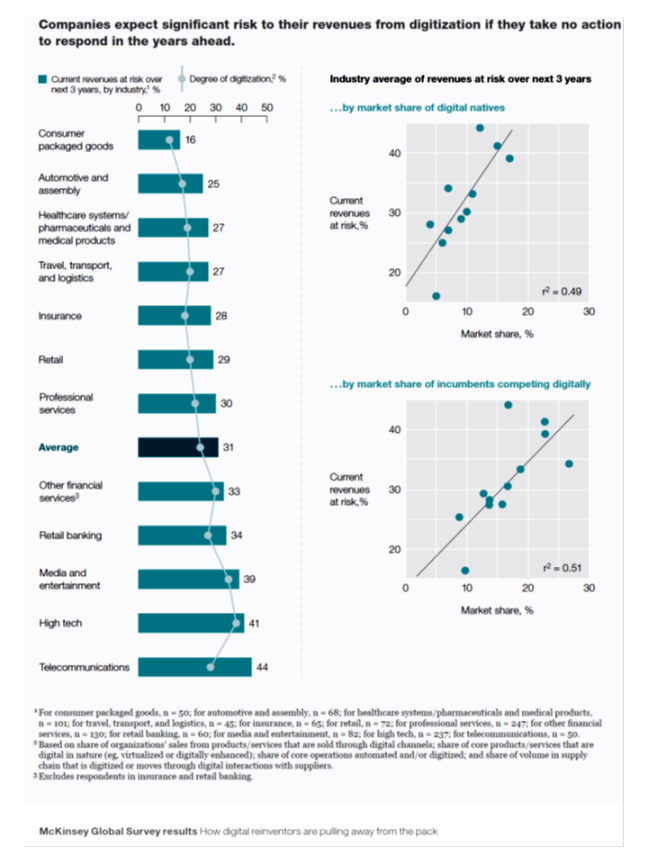

- Rapid and far-reaching advances in technology are reshaping competition and the process of value creation in every business sector.

- The struggle to deal with climate change is beginning to transform the economics of extractive industries and others.

- Global supply chains are challenged by geopolitical and mercantile conflicts.

- Investor scrutiny is more demanding than ever.

- Society’s expectations of business are increasing as governments struggle to address mounting challenges—income inequality, threats to data privacy, crumbling infrastructure, global warming, and so forth.

Each of these changes in itself is seismic. But what makes the current epoch uniquely unpredictable and hard to navigate is the fact that these changes are happening concurrently, interacting with and amplifying each other, as illustrated in the figure below. As a result, companies may find it extremely difficult to anticipate the full impact or the second- or third-order effects of these disruptions in the next few years. This is especially true for boards of directors and their leaders, whose job it is to secure the long-term success of their companies. It is a challenge that is not going away any time soon—indeed, all indications are that it will become more acute.

AN EXISTENTIAL THREAT

As last year’s Blue Ribbon Commission report on board oversight of disruptive risks pointed out, these trends

- “have the potential to change industry structure or operating conditions,

- make existing business models obsolete,

- derail growth,

- or otherwise pose a fundamental threat [or transformative opportunity] to the long-term strategy of the organization.”

But while the threats are clearly existential, it is far from clear that all companies and their boards are adequately equipped to respond, because many of the big issues facing business are in new or uncharted territories. Technology is one obvious disruptor which is reshaping industries and forcing companies to consider new forms of collaboration that would have been unimaginable a few years ago. For example, the car industry is having to retool its entire production system to meet rising projected demand for electric vehicles while forming partnerships and joint ventures with leading software providers to exploit the emerging markets for autonomous cars. The competitive battleground and source of value creation has shifted rapidly and radically from the vehicles’ hardware to the systems driving it. Another challenge is the complex issue of climate change, where companies are feeling their way toward a response to fundamental market shifts involving international politics, governmental regulation, and investor expectations while considering the economic impact of climate risk. Boards need to bolster their capacity to navigate this labyrinth. A third and rapidly-moving set of challenges is emerging from tectonic shifts in geopolitics and in particular from the rise of great-power rivalry, trade protectionism, and mercantilism—notably in the domain of technology, where the United States and China are engaged in what some see as a new arms race for control over the systems of the future.

Overarching all of these trends is another relatively new pressure: the pressure for companies to articulate and justify their broader purpose, in terms of how they address society’s unmet needs in an era of great social change, activism, and political uncertainty. This is certainly the message from some of the largest institutional investors. As Larry Fink, CEO of BlackRock, put it in his 2019 CEO letter to portfolio companies, “Companies that fulfill their purpose and responsibilities to stakeholders reap rewards over the long-term. Companies that ignore them stumble and fail. This dynamic is becoming increasingly apparent as the public holds companies to more exacting standards. And it will continue to accelerate as millennials—who today represent 35 percent of the workforce—express new expectations of the companies they work for, buy from, and invest in.”

CREATIVE DESTRUCTION ACCELERATES

One important inference from these trends is that the formula for past success matters even less to companies considering their future. Research conducted in 2018 for the Fortune Future 500 initiative (the public companies with the best long-term growth outlook) shows that for large companies, there is now less correlation than there was before between past and future financial and competitive performance over multiple years. This means that companies can no longer hope to prosper merely by sticking to their historical growth strategies and competitive advantages. Relying on past success can engender complacency—itself an existential threat.

It is certainly true that the process Joseph Schumpeter called “creative destruction” is accelerating, and in consequence corporate lifespans are shrinking. A 2018 Innosight study showed that, based on recent trends, nearly half of the corporate constituents of the S&P 500 could be expected to be replaced over the next 10 years. While companies in the S&P 500 had an average tenure of 33 years in 1964, tenures had narrowed to 24 years by 2016 and are forecasted to shrink to just 12 years by 2027. This accelerating churn is to be seen also among very young firms—for example, five-year survival rates for newly-listed firms have declined by nearly 30 percentile points (dropping from 92 percent to 63 percent) since the 1960s. In a parallel trend, the median CEO tenure for large-cap companies has been shrinking steadily over time—indeed, it dropped by one full year between 2013 and 2017. Median tenure is now five years.

Structural change and industry consolidation are also impacting the nature of competition, creating a “winnertakes-most” dynamic in an increasing number of business sectors. Recent research based on analysis of 5,750 of the world’s largest companies shows just how unevenly the fruits of success are now distributed in terms of economic profit (a measure of a company’s invested capital times its return above its weighted cost of capital). The top 10 percent of these companies captured fully 80 percent of positive economic profit between 1994 and 2016.

All of these implications are brought into sharper focus by the increasing shareholder scrutiny which companies are now under, not only from activist investors but also increasingly from institutional investors who wield their significant influence to demand change. Stephen Murray, the president and CEO of private equity firm CCMP Capital, goes so far as to say, “The whole activist industry exists because public boards are often seen as inadequately equipped to meet shareholder interests.” So the challenges for boards and management teams are stark—probably more so now than at any time since the birth of the modern corporation a little more than a century ago. They mean that some, though by no means all, of these individuals’ accumulated experience in strategy development and execution may be less relevant in the future than in the past. And they suggest that board leaders in particular need to adopt a new mind-set and consider a different modus operandi attuned to the demands of this rapidly-changing environment.

IMPLICATIONS FOR BOARDS

Three years ago, in its Report of the Blue Ribbon Commission on Building the Strategic-Asset Board, NACD first pointed out that a new leadership mandate for boards was emerging, driven by “an operating environment . . . that is characterized by increased complexity and uncertainty and includes new sources of risk and opportunity.” It highlighted the role of the board leader in driving a continuous improvement ethos to ensure that the board remains fit for its purpose. Yet performance expectations for boards continue to rise. In a 2019 NACD survey, 73 percent of directors reported that board leadership is more challenging now than it was three years ago, and 84 percent reported that performance expectations had gone up for all board members. Directors admit that they find it really challenging to keep up with change. In the same NACD survey, 36 percent of directors cited the struggle to stay abreast of the changing speed of business as one of the key impediments to the effectiveness of board leaders. Commissioners for this report echoed that concern and highlighted it as a challenge for the entire board. “Many directors don’t feel comfortable talking about emerging technologies, cybersecurity, and other complex topics,” said one Commissioner. “As a result, they tend to defer to others, which can become an abdication of their responsibility to be active board members.”

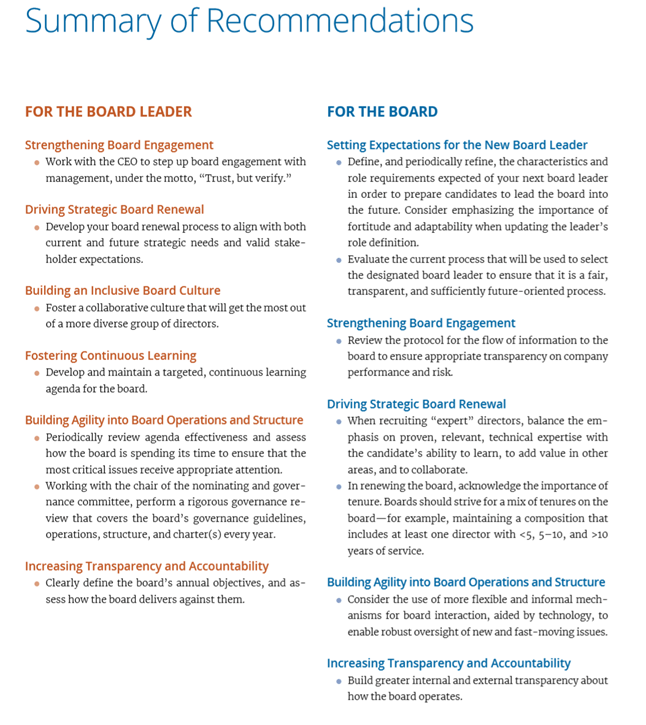

In the view of the Commission, this shifting business paradigm has profound and immediate implications for boards, and these implications will intensify dramatically over the next 5 to 10 years. They cover

- board engagement with management,

- board renewal,

- operations,

- transparency,

- and accountability.

Some of these implications are not new—indeed, boards have been grappling with all of them with greater or lesser success for some time. But there is no doubt that all of them have recently become more acute, and now pose an urgent challenge to board leaders.

- IMPLICATION 1: Boards must engage more proactively, deeply, and frequently on entirely new and fast-changing drivers of strategy and risk.

- IMPLICATION 2: Boards must approach their own renewal through the lens of shifting strategic needs to ensure longterm competitive advantage.

- IMPLICATION 3: Boards must adopt a more dynamic operating model and structure.

- IMPLICATION 4: Boards must be much more transparent about how they govern.

- IMPLICATION 5: Boards must hold themselves more accountable for individual director and collective performance.

SETTING EXPECTATIONS FOR THE NEW BOARD LEADER

The fundamental role of board leadership stays the same: building and maintaining high-performing boards that build long-term value. Here is how NACD has described board leaders and their role in its past Blue Ribbon Commission reports:

Board leaders are the linchpins on many key issues, including the board-CEO relationship, board dynamics and culture, setting the board agenda, information flows between the board and management, and stakeholder relations (especially board-shareholder engagement).

Many NACD principles and positions about what constitutes good board practice are contingent upon having a strong and effective leader in this role. Strong, qualified individuals in this role “[have] the ability to give the board a competitive advantage.”

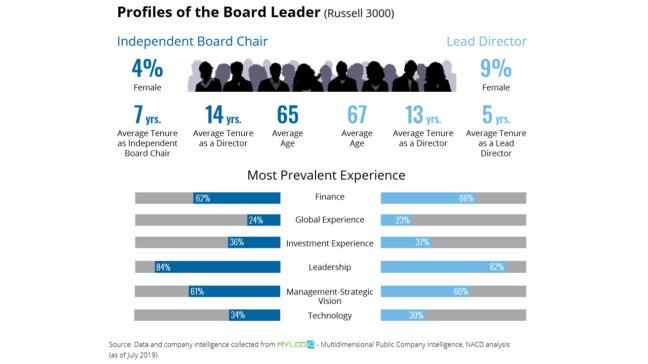

As seen in the infographic that follows, based on 2019 NACD analysis of S&P 500 chairs and lead directors, board leaders today have extensive tenure on the boards they serve, bringing with them strong institutional memory, and they almost always have past experience in business leadership roles and a proven track record in strategy and execution.

PRIORITY RESPONSIBILITIES FOR BOARD LEADERS OF TODAY

Lead the setting and monitoring of board performance goals that are regularly synchronized with the (shifting) business strategy.

- Drive alignment and connectivity. This includes staying connected on material new initiatives and strengthening alignment in how committees and the full board engage on crucial, but now fast-changing, issues such as strategy, risk, disruption, talent, corporate culture, incentives, and technology.

- Lead the setting of shared values and expectations for a well-functioning board, including the use of a fully candid board, committee, and individual-director performance evaluation.

- Pay continuous attention to (a) what’s working and why, (b) what’s not working and why, and (c) how the board can use this knowledge to improve its effectiveness.

- Spend considerable time in one-on-one discussions on key topics with other board members, the CEO, and the management team, with a focus on ensuring openness of discussion and constructive group dynamics.

DESIRED ATTRIBUTES FOR BOARD LEADERS OF TODAY

Fortitude and vigilance to ensure that changes in board processes and practices change behaviors over time

- Adaptability—a willingness to recognize a board’s new needs and responsibilities and adjust board practices, processes, agenda setting, and structures accordingly

- Superb communication skills, especially with regard to difficult communications, including sensitive messages to the CEO and to fellow directors

- Aptitude for relationship building, not just with the board, the CEO, and the senior team, but also with key shareholders, stakeholders, and regulators

- Inclusiveness—ensuring that the growing diversity of the boardroom is optimized, and enhancing collaboration that is inclusive of different, unconventional thinking

- Humility—placing a high premium on listening and seeking to understand the (contrasting) views of others. The successful board leader presents himself/herself as “last among equals”

STRENGTHENING BOARD ENGAGEMENT

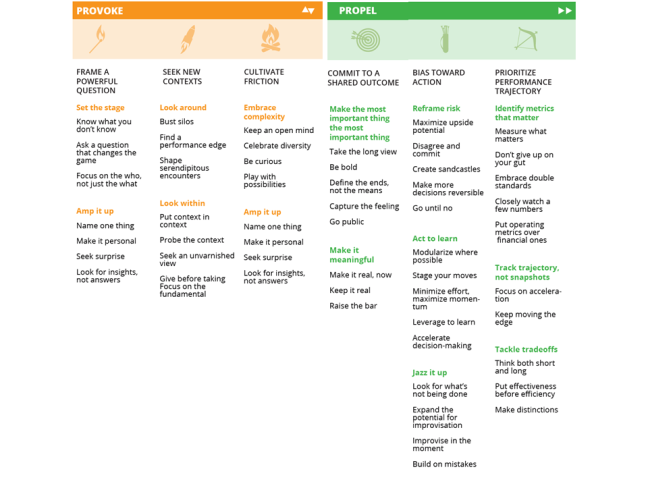

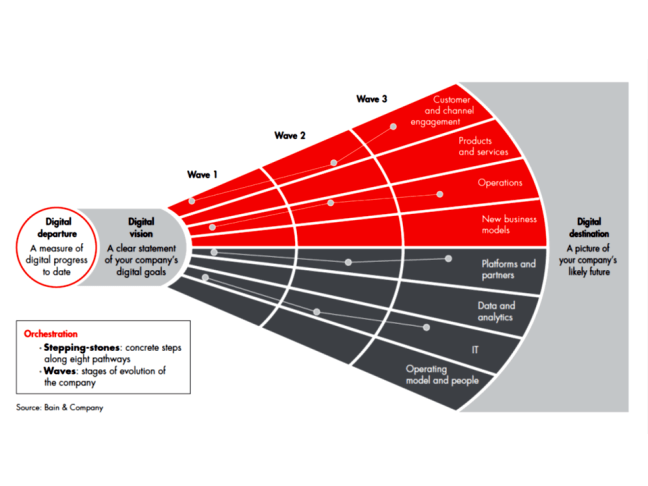

Board leaders will need to orchestrate more meaningful board engagement to help inform strategic choices and to understand the risks being taken in a much more uncertain and fast-changing environment. Earlier, we described the pressures for boards to become more actively engaged with their companies, without falling into the trap of micromanagement or losing the objectivity required to oversee the business. We suggest that this requires collaboration and candid dialogue between boards and management teams about respective roles and responsibilities.

- Clarifying where the board would like to seek deeper involvement and why this creates better governance. Examples might be earlier and more in-depth understanding/verification of strategy development and underlying assumptions, preparations for responding to disruption, and plans for major corporate transformations.

- Creating a shared picture of the present, and of the future, and of where the industry and the competition are headed, and of what that means for strategy.

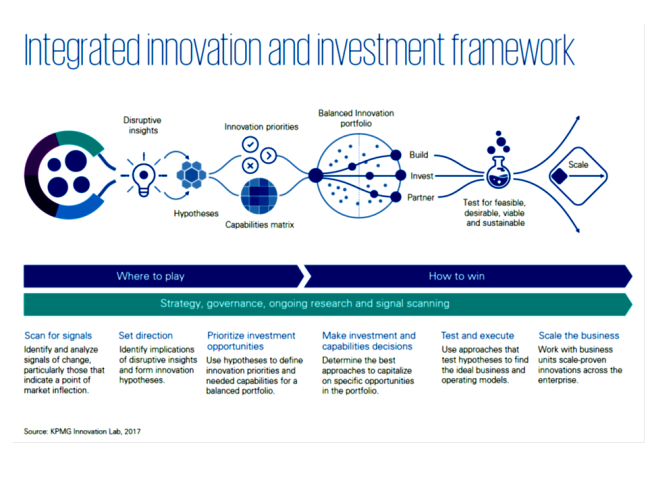

- Enhancing board focus on innovation and change. Here is another shift made imperative by the speed of business change. Where in the past a board’s typical posture may have been to act as a brake on management’s ambitions, an equally important goal should now be to work with management to ensure that they embrace innovation and can successfully drive change in the organization.

- Assessing how well management is maintaining critical alignments among key determinants of performance (e.g., strategy, risk management, innovation, controls, incentives, culture, and talent). This becomes increasingly important as strategies are more frequently being recalibrated.

- Establishing a framework for more frequent, focused management communication with the board between formal meetings. This can help streamline the meetings themselves, freeing up time to focus on the most critical strategic matters.

DRIVING STRATEGIC BOARD RENEWAL

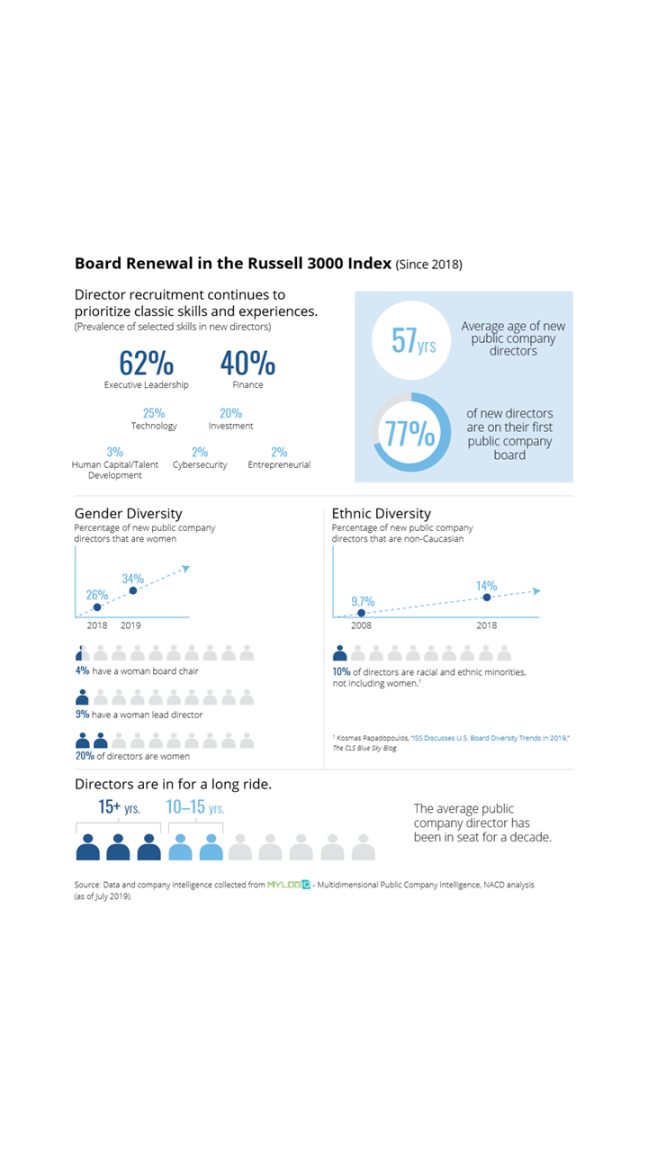

In order to deliver more meaningful and deeper engagement on entirely new issues, the board leader and the chair of the nominating and governance committee should thoroughly assess whether the board has the right human capital to fulfill its mandate and deliver ongoing value. One of the key questions will be whether the board’s existing composition is aligned with the challenges likely to face the business in the future sketched out together with the management team, and if not, how it should best be renewed. One useful way of thinking about this task could be a “clean-sheet” approach to board diversity and composition, which NACD first recommended in its Blue Ribbon Commission report on building the strategic-asset board. In particular, nominating and governance committees should consider asking the following questions:

- If we were to create a board from scratch today, what would it look like holistically, from the standpoint of skills, leadership styles, and backgrounds? What will we need in three, five, or more years?

- Have we sufficiently mapped out our strategy and risks into the future to understand what profiles we need?

- How should our board composition represent the characteristics of the company’s current and future customer base as well as its workforce?

- If we are anticipating adding one or more new directors in the next couple of years, have we vetted our recruitment profile to ensure criteria are relevant and that they are not unnecessarily restricting access to appropriate candidates (e.g., requiring CEO or prior board experience)?

BUILDING AN INCLUSIVE BOARD CULTURE

Boards already know how to be purposeful in seeking out individuals who bring a variety of backgrounds, perspectives, and skills. Now they need to be just as purposeful in creating an environment that enables those diverse voices to be heard. The board leader has a critical role to play in activating diversity in the boardroom by recognizing that the aim is not “hiring for diversity and then managing for assimilation.” The goal of the board leader after bringing in new board members is not assimilation but rather enhancing collaboration that is inclusive of different, unconventional thinking. With higher levels of diversity in the boardroom—whether this is diversity in experience, skills, gender, race, ethnicity, or age—it’s critical for board leaders to create a culture that facilitates constructive and candid interactions between board members and that ensures that each director is heard from on important issues.

FOSTERING CONTINUOUS LEARNING

“Continuous lifelong learning’’ is such an oft-heard phrase that it’s close to becoming a cliché. But it’s nonetheless a worthwhile approach for boards and management teams to adopt—because when the pace of change is accelerating, “the fastest-growing companies and most resilient workers will be those who learn faster than their competition.”

This, too, will function most effectively as a collaborative effort between the board and the management team. It’s the role of management to help educate the board about the future and its impact on strategy. The board leader should help the C-suite understand the board’s expectations for the learning process, the time line, and the board’s information needs. At the same time, the board leader should set the expectation that directors not rely solely on management for all of the information they receive, but rather seek out other external sources proactively to deepen their understanding of the business. The agenda for potential learning is vast and constantly growing. “Some learning opportunities may be specific to individual directors; others may be common to all members of a committee or to the entire board (e.g., raising the board’s collective knowledge about cyber threats). Individual, committee, or board-level learning agendas might include

- industry-specific topics;

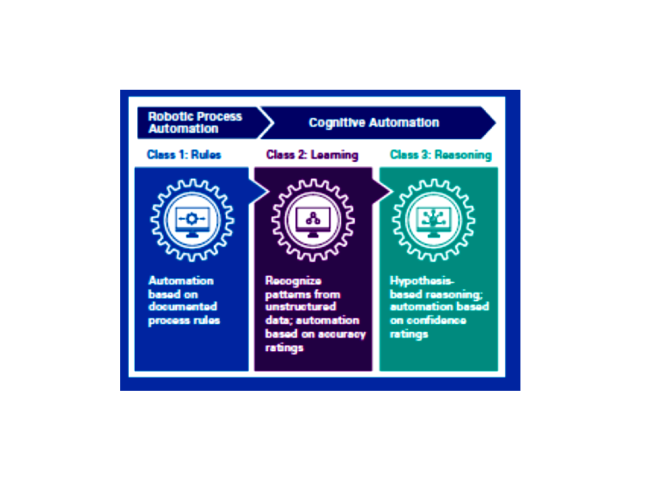

- emerging economic and technology trends;

- governance matters;

- regulatory developments;

- shareholder/stakeholder issues;

- and/or team dynamics and decision making.”

Commissioners offered a number of observations about the pursuit of structured board learning:

- First, that it is not just a matter for board leaders and committee chairs—it is a collective task for the whole board to stay “constantly curious.” This can be assisted through experiential learning, where the board visits company sites or meets local managers.

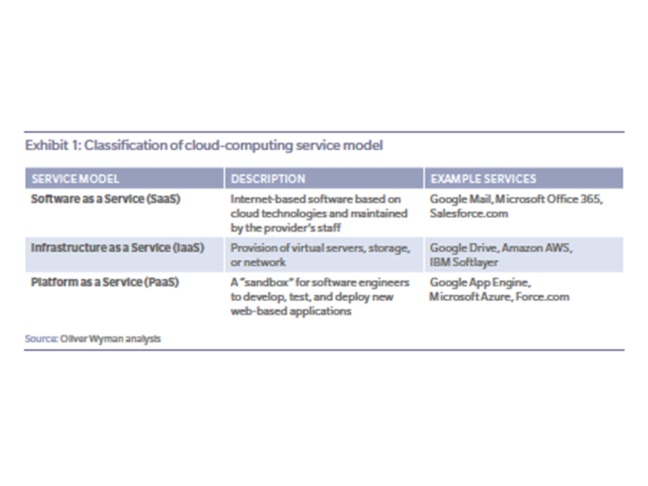

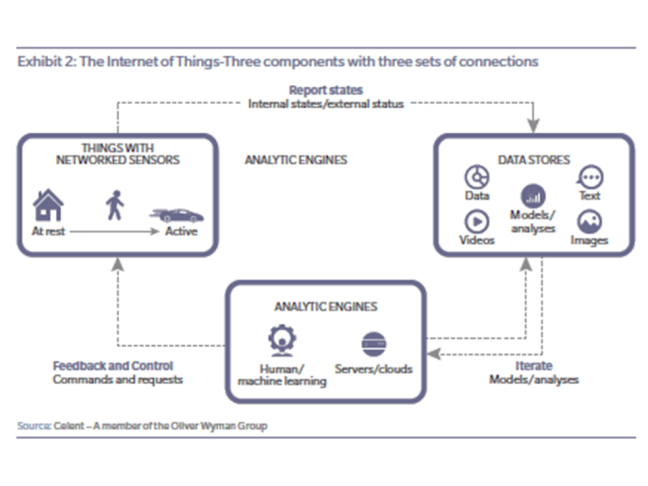

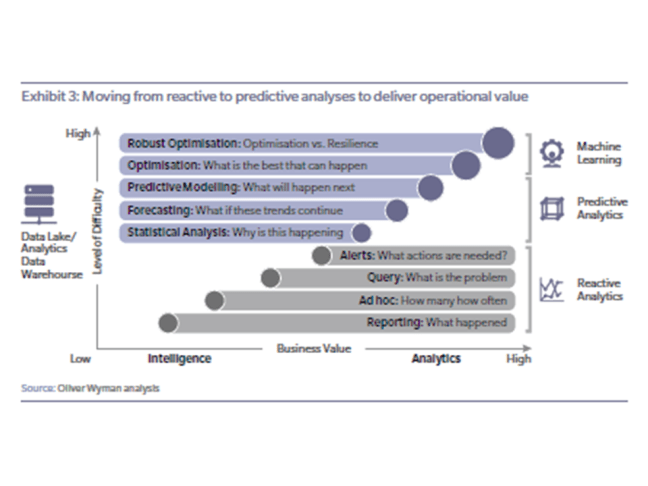

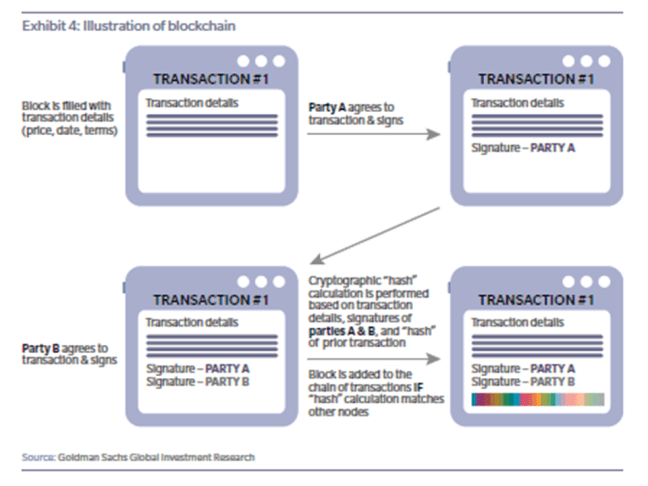

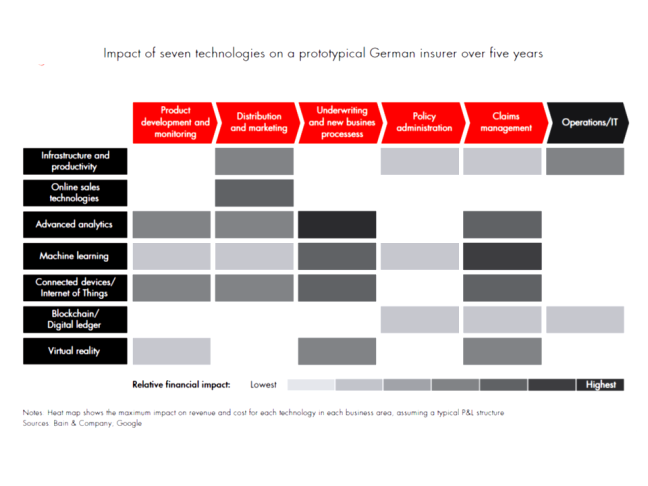

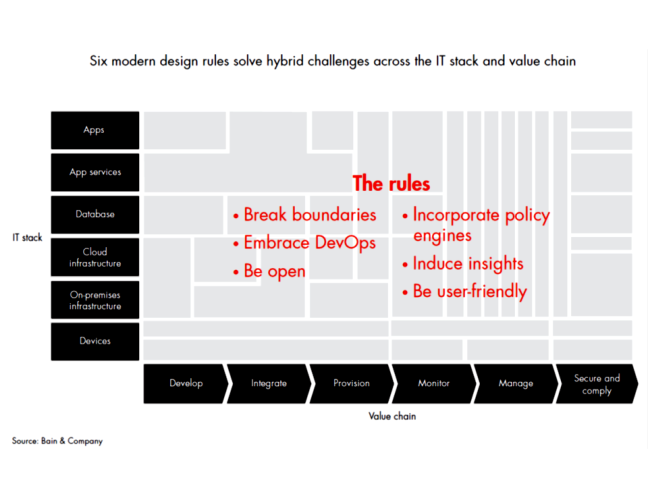

- Second, there is a constant need to focus collective learning on new technologies—not just the features of emerging technologies but also the reasons why they are so disruptive and how competitors have succeeded in commercializing them.

- Third, longer-serving directors will benefit from periodically refreshing their knowledge of the basics—for example, by joining new director orientation in order to understand how management’s presentation of the issues may have changed.

- Finally, the learning imperative applies equally to management. To this end, selected executives should be encouraged to take board positions with companies that are not competitors.

BUILDING AGILITY INTO BOARD OPERATIONS AND STRUCTURE

As stated earlier, the dynamic external environment requires boards to be more careful than before about how they allocate their time, but also more flexible in responding to events. The starting point is effective agenda setting for board meetings.

Agendas

The Commissioners offered a number of specific ideas for enhancing board meeting effectiveness:

- First, think holistically about the entire cycle of meetings throughout the year and not just about the agenda for individual meetings. The objective is to ensure the highest return on the time that the board spends together and with management—including what happens outside, around, and in between the actual board meetings.

- Second, make a deliberate effort to ensure that board meetings are not predominantly focused on the past and on compliance—on the rear-view mirror, so to speak. Create “white space” time for open conversation and time to delve into identified issues of importance. Foster dialogue and minimize time spent on formal presentations.

- Third, take a strategic and almost mathematical approach to time allocation. One Commissioner described how the board tracks how it is spending its time in meetings, then asks board members their opinions about how the board should be spending time, and periodically optimizes the mix.

- Fourth, try to maximize one-on-one time with the CEO and the board. It is important to spend time with the CEO without other managers present. An hour and sometimes more at the start of every meeting, and then again at the end, coupled with a CEO/director-only dinner, is an effective way “to get everything that needs airing out on the table.”