Customers are changing the way they buy financial services. That means that firms can’t afford to sit on the sidelines when it comes to their digital capabilities. But a bank shouldn’t think of a digital transformation as only a way to stay ahead of the competition. A bank should make sure its transformation fits its strategy, because transformation is really all about strategy.

- What makes sense for your bank?

- Where are you succeeding with customers?

- What can help you keep going down that road?

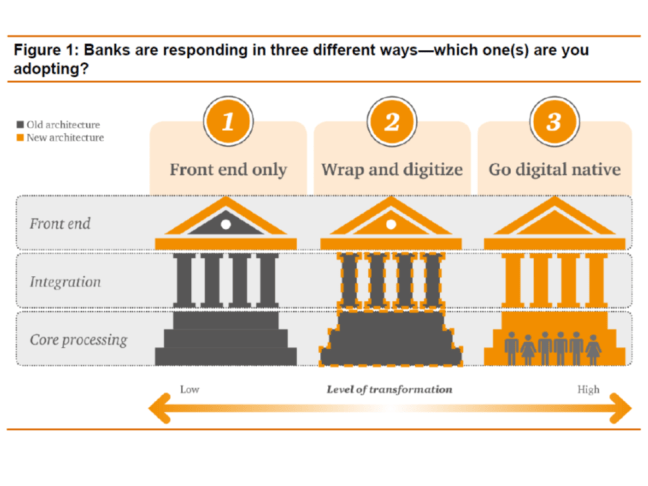

While it’s important to keep up with competitors, your digital transformation should be tailored to your bank’s particular needs. Each institution has its own footprint, legacy infrastructure, customer demographics, and so on. Let’s explore the three most common approaches to digital transformation in more detail (see Figure 1). Each option creates a different customer experience, has a varying effect on profitability, and comes with its own set of challenges. From there, we’ll discuss how you should weave in digital transformation as part of your overall strategy and what you can do to get started now.

The simplest approach is to modify the front end only, focusing on the primary ways a customer interacts with a bank (website, app, etc.). Largely a cosmetic fix, the bank designs an appealing mobile app and web interface but keeps the organization’s workflows, culture, and back-end infrastructure intact. We understand the appeal of this approach. For an organization that needs a quick win, it’s certainly the fastest route. In fact, this approach may be a quick interim step for banks that have real client-facing issues. It’s a solid stop on the road of transformation, but for most banks, it won’t be the destination.