The ebb and flow of attitudes on the adoption and use of technology has evolving ramifications for financial services firms and their compliance functions, according to the findings of the Thomson Reuters Regulatory Intelligence’s fourth annual survey on fintech, regtech and the role of compliance. This year’s survey results represent the views and experiences of almost 400 compliance and risk practitioners worldwide.

During the lifetime of the report it has had nearly 2,000 responses and been downloaded nearly 10,000 times by firms, risk and compliance practitioners, regulators, consultancies, law firms and global systemically-important financial institutions (G-SIFIs). The report also highlights the shifting role of the regulator and concerns about best or better practice approaches to tackle the rise of cyber risk. The findings have become a trusted source of insight for firms, regulators and their advisers alike. They are intended to help regulated firms with planning, resourcing and direction, and to allow them to benchmark whether their resources, skills, strategy and expectations are in line with those of the wider industry. As with previous reports, regional and G-SIFI results are split out where they highlight any particular trend. One challenge for firms is the need to acquire the skill sets which are essential if they are to reap the expected benefits of technological solutions. Equally, regulators and policymakers need to have the appropriate up-todate skillsets to enable consistent oversight of the use of technology in financial services. Firms themselves, and G-SIFIs in particular, have made substantial investments in skills and the upgrading of legacy systems.

Key findings

- The involvement of risk and compliance functions in their firm’s approach to fintech, regtech and insurtech continues to evolve. Some 65% of firms reported their risk and compliance function was either fully engaged and consulted or had some involvement (59% in prior year). In the G-SIFI population 69% reported at least some involvement with those reporting their compliance function as being fully engaged and consulted almost doubling from 13% in 2018, to 25% in 2019. There is an even more positive picture presented on increasing board involvement in the firm’s approach to fintech, regtech and insurtech. A total of 62% of firms reported their board being fully engaged and consulted or having some involvement, up from 54% in the prior year. For G-SIFIs 85% reported their board being fully engaged and consulted or having some involvement, up from 56% in the prior year. In particular, 37% of G-SIFIs reported their board was fully engaged with and consulted on the firm’s approach to fintech, regtech and insurtech, up from 13% in the prior year.

- Opinion on technological innovation and digital disruption has fluctuated in the past couple of years. Overall, the level of positivity about fintech innovation and digital disruption has increased, after a slight dip in 2018. In 2019, 83% of firms have a positive view of fintech innovation (23% extremely positive, 60% mostly positive), compared with 74% in 2018 and 83% in 2017. In the G-SIFI population the positivity rises to 92%. There are regional variations, with the UK and Europe reporting a 97% positive view at one end going down to a 75% positive view in the United States.

- There has been a similar ebb and flow of opinion about regtech innovation and digital disruption although at lower levels. A total of 77% reported either an extremely or mostly positive view, up from 71% in the prior year. For G-SIFIs 81% had a positive view, up from 76% in the prior year.

- G-SIFIs have reported a significant investment in specialist skills for both risk and compliance functions and at board level. Some 21% of G-SIFIs reported they had invested in and/or appointed people with specialist skills to the board to accommodate developments in fintech, insurtech and regtech, up from 2% in the prior year. This means in turn 79% of G-SIFIs have not completed their work in this area, which is potentially disturbing. Similarly, 25% of G-SIFIs have invested in specialist skills for the risk and compliance functions, up from 9% in the prior year. In the wider population 10% reported investing in specialist skills at board level and 16% reported investing in specialist skills for the risk and compliance function. A quarter (26%) reported they have yet to invest in specialist skills for the risk and compliance function, but they know it is needed (32% for board-level specialist skills). Again, these figures suggest 75% of G-SIFIs have not fully upgraded their risk and compliance functions, rising to 84% in the wider population.

- The greatest financial technology challenge firms expect to face in the next 12 months have changed in nature since the previous survey, with the top three challenges cited as keeping up with technological advancements; budgetary limitations, lack of investment and cost; and data security. In prior years, the biggest challenges related to the need to upgrade legacy systems and processes as well as budgetary limitations, the adequacy and availability of skilled resources together with the need for cyber resilience. In terms of the greatest benefits expected to be seen from financial technology in the next 12 months the top three are a strengthening of operational efficiency, improved services for customers and greater business opportunities.

- G-SIFIs are leading the way on the implementation of regtech solutions. Some 14% of G-SIFIs have implemented a regtech solution, up from 9% in the prior year with 75% (52% in the prior year) reporting they have either fully or partially implemented a regtech solution to help manage compliance. In the wider population, 17% reported implementing a regtech solution, up from 8% in the prior year. The 2018 numbers overall showed a profound dip from 2017 when 29% of G-SIFIs and 30% of firms reported implementing a regtech solution, perhaps highlighting that early adoption of regtech solutions was less than smooth.

- Where firms have not yet deployed fintech or regtech solutions various reasons were cited as to what was holding them back. Significantly, one third of firms cited lack of investment; a similar number of firms pointed to a lack of in-house skills and information security/data protection concerns. Some 14% of firms and 12% of G-SIFIs reported they had taken a deliberate strategic decision not to deploy fintech or regtech solutions yet.

- There continues to be substantial variation in the overall budget available for regtech solutions. A total of 38% of firms (31% in prior year) reported that the expected budget would grow in the coming year, however, 31% said they lack a budget for regtech (25% in the prior year). For G-SIFIs 48% expected the budget to grow (36% in prior year), with 12% reporting no budget for regtech solutions (6% in the prior year).

Focus : Challenges for firms

Technological challenges for firms come in all shapes and sizes. There is the potential, marketplace changing, challenge posed by the rise of bigtech. There is also the evolving approach of regulators and the need to invest in specialist skill sets. Lastly, there is the emerging need to keep up with technological advances themselves.

The challenges for firms have moved on. In the first three years of the report the biggest financial technology challenge facing firms was that of the need to upgrade legacy systems and processes. This year the top three challenges are expected to be the need to keep up with technology advancements; perceived budgetary limitations, lack of investment and cost, and then data security.

Focus : Cyber risk

Cyber risk and the need to be cyber-resilient is a major challenge for financial services firms which are targets for hackers. They must be prepared and be able to respond to any kind of cyber incident. Good customer outcomes will be under threat if cyber resilience fails.

One of the most prevalent forms of cyber attack is ransomware. There are different types of ransomware, all of which will seek to prevent a firm or an individual from using their IT systems and will ask for something (usually payment of a ransom) to be done before access will be restored. Even then, there is no guarantee that paying the fine or acceding to the ransomware attacker’s demands will restore full access to all IT systems, data or files. Many firms have found that critical files often containing client data have been encrypted as part of an attack and large amounts of money are demanded for restoration. Encryption is in this instance used as a weapon and it can be practically impossible to reverse-engineer the encryption or “crack” the files without the original encryption key – which cyber attackers deliberately withhold. What was previously viewed often as an IT problem has become a significant issue for risk and compliance functions. The regulatory stance is typified by the UK Financial Conduct Authority (FCA) which has said its goal is to “help firms become more resilient to cyber attacks, while ensuring that consumers are protected and market integrity is upheld”. Regulators do not expect firms to be impervious but do expect cyber risk management to become a core competency.

Good and better practice on defending against ransomware attacks Risk and compliance officers do not need to become technological experts overnight but must ensure cyber risks are effectively managed and reported on within their firm’s corporate governance framework. For some compliance officers, cyber risk may be well outside their comfort zone but there is evidence that simple steps implemented rigorously can go a long way towards protecting a firm and its customers. Any basic cyber-security hygiene aimed at protecting businesses from ransomware attacks should make full use of the wide range of resources available on cyber resilience, IT security and protecting against malware attacks. The UK National Cyber Security Centre has produced some practical guidance on how organizations can protect themselves in cyberspace, which it updates regularly. Indeed, the NCSC’s 10 steps to cyber security have now been adopted by most of the FTSE350.

Closing thoughts

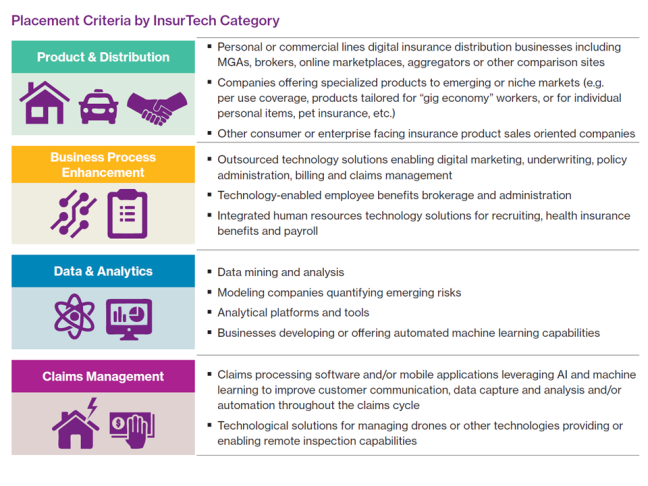

The financial services industry has much to gain from the effective implementation of fintech, regtech and insurtech but practical reality is there are numerous challenges to overcome before the potential benefits can be realised. Investment continues to be needed in skill sets, systems upgrades and cyber resilience before firms can deliver technological innovation without endangering good customer outcomes.

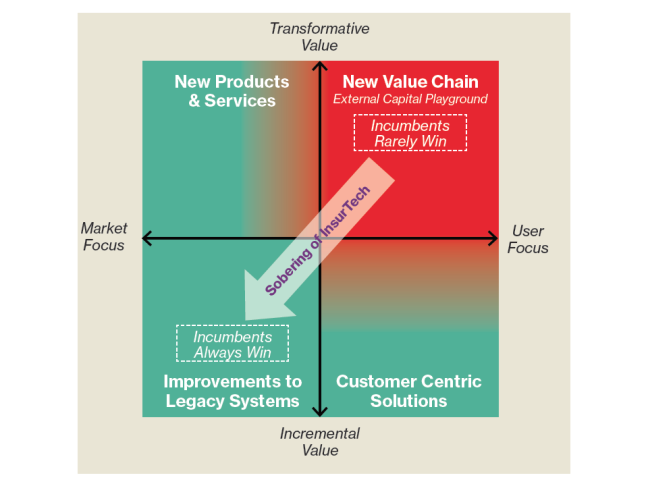

An added complication is the business need to innovate while looking over one shoulder at the threat posed by bigtech. There are also concerns for solution providers. The last year has seen many technology start-ups going bust and far fewer new start-ups getting off the ground – an apparent parallel, at least on the surface, to the bubble that was around dotcom. Solutions need to be practical, providers need to be careful not to over promise and under deliver and above all developments should be aimed at genuine problems and not be solutions looking for a problem. There are nevertheless potentially substantive benefits to be gained from implementing fintech, regtech and insurtech solutions. For risk and compliance functions much of the benefit may come from the ability to automate rote processes with increasing accuracy and speed. Indeed, when 900 respondents to the 10th annual cost of compliance survey report were asked to look into their crystal balls and predict the biggest change for compliance in the next 10 years, the largest response was automation.

Technology and its failure or misuse is increasingly being linked to the personal liability and accountability of senior managers. Chief executives, board members and other senior individuals will be held accountable for failures in technology and should therefore ensure their skill set is up-to-date. Regulators and politicians alike have shown themselves to be increasingly intolerant of senior managers who fail to take the expected reasonable steps with regards to any lack of resilience in their firm’s technology.

This year’s findings suggest firms may find it beneficial to consider:

- Is fintech (and regtech) properly considered as part of the firm’s strategy? It is important for regtech especially not to be forgotten about in strategic terms: a systemic failure arising from a regtech solution has great capacity to cause problems for the firm – the UK FCA’s actions on regulatory reporting, among other things, are an indicator of this.

- Not all firms seem to have fully tackled the governance challenge fintech implies: greater specialist skills may be needed at board level and in risk and compliance functions.

- Lack of in-house skills was given as a main reason for failing to develop fintech or regtech solutions. It is heartening that firms understand the need for those skills. As fintech/regtech becomes mainstream, however, firms may be pressed into developing such solutions. Is there a plan in place to plug the skills gap?

- Only 22% of firms reported that they need more resources to evaluate, understand and deploy fintech/ regtech solutions. This suggests 78% of firms are unduly relaxed about the resources needed in the second line of defence to ensure fintech/regtech solutions are properly monitored. This may be a correct conclusion, but seems potentially bullish.