Executive summary

New challenges, changing business dynamics have set off a tectonic shift in the insurance industry

- Customer expectations are evolving, offers are becoming more innovative, and new players are making their presence known.

- Fundamental and significant challenges will require insurers’ immediate and considered attention.

- As a result of these changing dynamics, incumbents and InsurTechs agree that collaboration with other industry players is necessary to create an integrated portfolio of offerings.

Insurers must support a platform that serves a broad spectrum of customer needs

- The future marketplace will showcase a bouquet of offerings that caters to customers’ financial and non-financial needs.

- Insurers need a structured approach to marketplace development that includes proper identification of customer preferences and relevant offerings, evaluation of best-fit partners, and an effective GTM strategy.

- Today’s operating model will undergo a fundamental transformation as part of the inevitable path forward.

Experience-led digital offerings and seamless collaboration with ecosystem players will drive marketplace success

- Insurers will need to tear down internal silos, seamlessly connect with ecosystem players, and be more inventive.

- Our Inventive Insurer profile includes key characteristics:

- intelligent insurer,

- open insurer,

- deep customer,

- and product agility.

Incumbent-InsurTech collaboration can shore up competencies in preparation for the future

- InsurTechs’ unique capabilities and agility make them ideal partners for incumbents aiming to carve out a substantive role in the new marketplace.

- A successful holistic collaboration will focus on long-term benefits.

New ecosystem roles will evolve as the industry transitions toward the marketplace model

- Industry players must decide how to successfully and profitably contribute to the new ecosystem based on their most compelling competencies, as well as market needs and the external environment.

There’s no looking back for today’s digitally-empowered consumers

Throughout the past decade, as smart technology tools became mainstream, consumer interaction with the world changed dramatically. Changing lifestyles, behavior, and preferences have created a digital-age paradigm. As smartphones and the internet unlock information and decision power, interconnectivity, personalization, and seamless omnichannel access have become must-haves.

So, what does this mean for insurers?

Policyholders seek new offerings: Traditional insurance policies may not fully meet customers’ changing needs and desire for add-on services, personalization, and flexible offerings. In fact, for nearly half of policyholders, the decision to continue with their insurer is influenced by the availability of these features and benefits, according to the World Insurance Report (WIR) 2019.1

The demand for digital transaction channels is up: The popularity of digital channels is gradually growing. More than half of insurance customers (nearly 52%) interviewed as part of the WIR 2018 placed high importance on the mobile and internet or a website channel for conducting insurance transactions.

Simplicity is the rationale behind genuinely digital products

Digital channels work best when insurers streamline and standardize products and processes so customers easily understand features and benefits and can make direct purchases online with ease. In short, insurers must simplify offerings to create genuinely

digital products.

- Easy to understand: Policy details should be redesigned and reformatted for straightforward interpretation so customers can quickly make a buy/ no-buy decision. For example, Berkshire Hathaway’s Insurance Group (BiBerk) launched a comprehensive insurance product for small businesses that combines multiple coverages. Dubbed THREE, the new product is three-pages long and links coverage for workers compensation, liability (including general liability, errors and omissions, and cyber), property, and auto.

- Automated processes: Straight-through processing and other ease-of-use tools can simplify underwriting, claims processing, and more across the value chain. Cake Insure, a subsidiary of Colorado-based Pinnacol Assurance, launched in late 2017 with an algorithm that produces a bindable quote in less than a minute and a bound policy in fewer than five minutes for small businesses seeking workers’ compensation insurance. New York-based property and casualty InsurTech Lemonade uses artificial intelligence to automate claims processing. Lemonade showcases a 2016 case in which it crossreferenced a claim against a user’s policy, ran 18 anti-fraud algorithms, approved the claim, and sent wiring instructions to the bank in three seconds to demonstrate ease of use.

- Straightforward policy wording: Descriptions of policy coverage and expenses (which ones are payable and which do not qualify) must be explained clearly in everyday language. Similarly, insurance industry players should work together to standardize definitions, exclusions, and processes.

- Interactive customer education: Gamification, interactive videos, and social channels are ways to educate customers about risks, their need for coverage, and policy details. Interaction can also improve customer engagement and experience.

The marketplace of the future can holistically focus on customer needs

HomeFlix is a virtual assistant offering renters and homeowners insurance underwritten by Zurich Connect, the digital arm of Zurich Italy, and powered by on-demand digital broker Yolo, a Milan-based InsurTech. In addition to insurance coverage, the policy, introduced in July 2019, offers laundry service – washed and ironed after a few days and paid directly on delivery. Access to concierge maintenance services such as plumbing and electric also is available. Next, HomeFlix plans home delivery, babysitting, and cleaning services.

New York-based Generali Global Assistance (a division of Italy’s Generali Group, which provides travel insurance-related services) strategically partnered with San Francisco-based rideshare company Lyft in late 2017 to improve customer service and contain costs for clientele of its insurance companies and multinational corporations. Later, Lyft

collaborated with CareLinx, a US professional caregiver marketplace that helps find, hire, manage and pay caregivers online, to create CareRides, a door-to-door transportation service for special-needs individuals in 50 US metro areas. Generali Global Assistance also partnered with CareLinx to provide value-added services for existing policyholders in times of need.

The marketplace of the future can offer emerging-risk coverage

Working with Cisco, Apple, and Aon, Allianz launched a comprehensive cyber insurance product for businesses in early 2018. The product includes a solution comprised of cyber-resilience evaluation services from Aon, secure technologies from Cisco and Apple, and options for enhanced cyber insurance coverage from Allianz. The product aims to help a broader range of organizations manage and protect themselves better from cyber risks associated with ransomware and malware-related threats.

The marketplace of the future can deliver simple to understand, easy-access offerings

Berlin-based startup FRIDAY offers innovative, digital automotive insurance with features like kilometeraccurate billing, the option to terminate at month’s end, and paperless administration. The InsurTech’s technologies and partnerships include:

- Telematics support from the BMW CarData platform and from TankTaler, which tracks vehicle location as well as data such as battery voltage, mileage, and other statistics

- Automotive services through the mobility hub of ATU, a German chain of vehicle repair franchises

- Drivy, a peer-to-peer car rental marketplace that enables consumers to lease vehicles from private individuals

- Friendsurance, a peer-to-peer InsurTech that pays out a percentage to customers who do not use (or use very little) annual insurance also sells FRIDAY policies

Prudential Singapore and StarHub partnered to create FastTrackTrade (FTT), Singapore’s first digital trade platform for small and midsized business (SMBs) that uses blockchain technology. FTT helps SMBs find business partners and distributors, buy and sell goods, track shipments, receive and make payments, access financing, and buy insurance via a single platform. FinTech startup Cités Gestion developed the pioneering platform with funding from Prudential.

Structure supports success

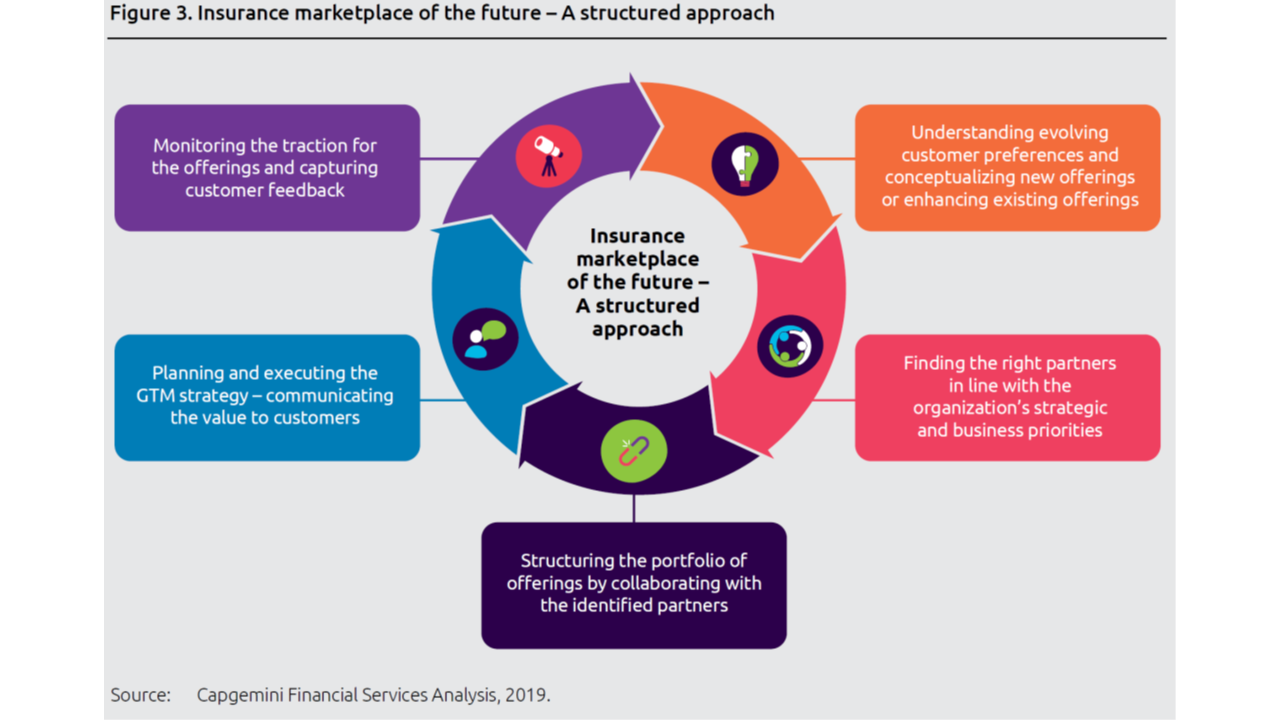

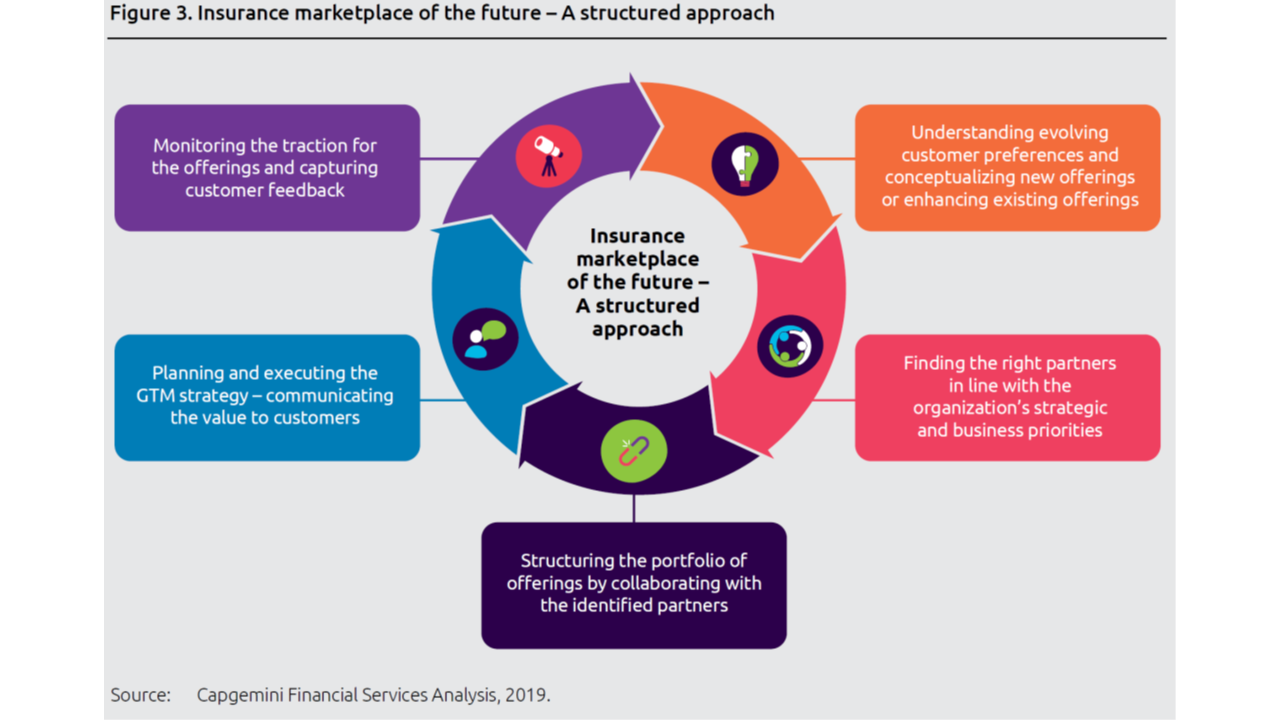

Insurer success in the future marketplace will rely on a structured approach (see Figure 3).

- Understanding customer preferences and conceptualizing product portfolios: Insurers can tap new data sources such as social media channels and use behavioral analytics for better understanding and more accurate estimation of their customer’s preferences and risk profile. With a deeper understanding of customers, they can conceptualize personalized product portfolios for each customer segment.

- Recruiting the right partners: Once the product portfolio is finalized, insurers should look for partners that align with their business objectives and strategic vision. Cultural fit, ease of integration of systems, and seamless channels of communication are key success factors.

- Structuring the offerings portfolio: Insurers should closely collaborate with partners while assembling their portfolio. A winning product/service mix offers a hyper-personalized one-stop solution for all the needs of the customer.

- A compelling go-to-market strategy: Insurers should be able to communicate the value of the marketplace by touting human-centric offerings that customers find simple to understand and easy to access.

- Capturing feedback: Through advanced analysis of sales data, direct customer input, social media, etc., insurers can capture feedback about their offerings. The process should be continuous rather than on an ad-hoc basis. More importantly, the input should be immediately acted upon to enhance current products or to conceptualize a new product.

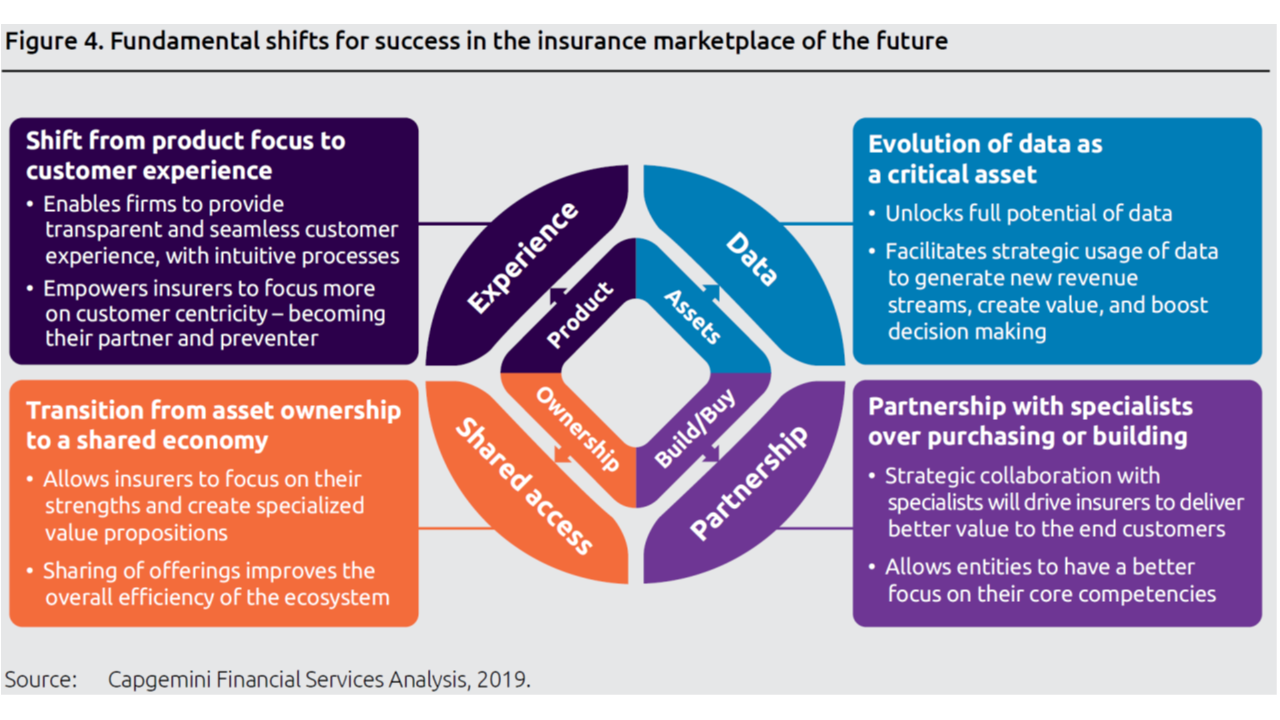

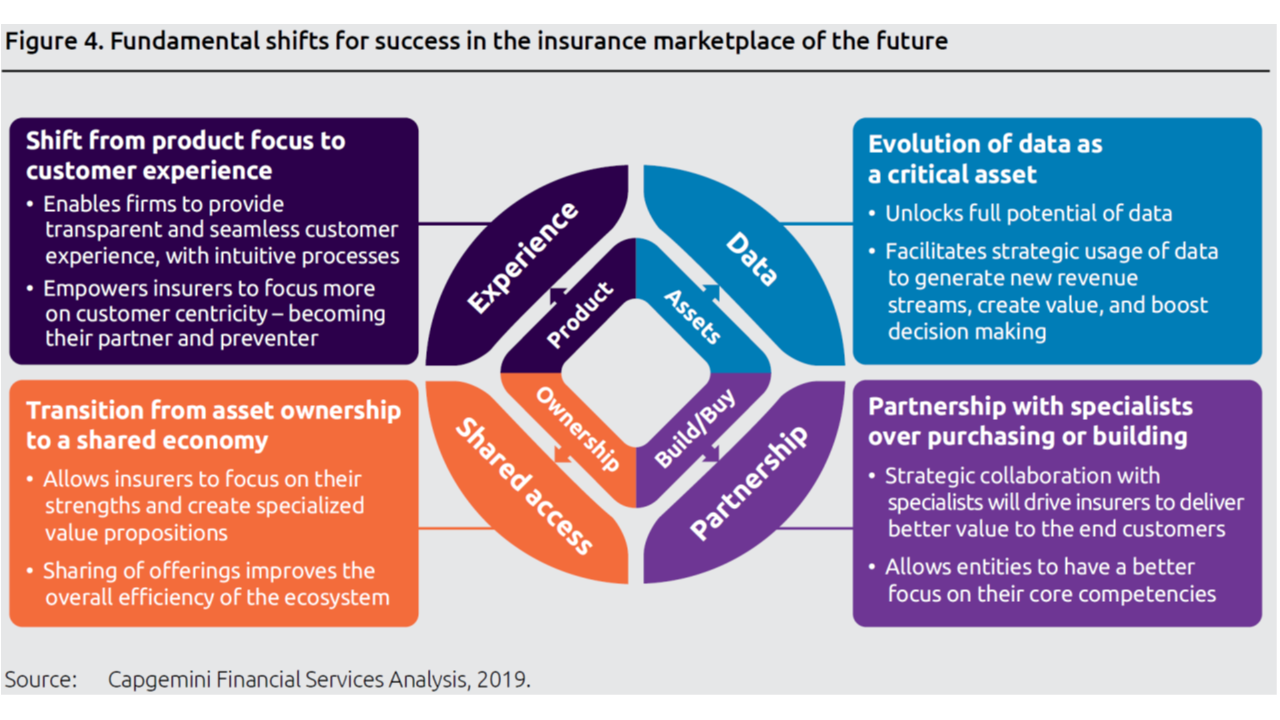

To realize the full potential of the structured approach, four fundamental shifts in the current operating model are critical

For an insurer to realize the full potential of the structured approach and ensuring the successful creation of the marketplace of the future, four fundamental shifts in the current operating model are critical (see Figure 4). The importance of these areas is borne out by the research. For example:

- Experience: More than 70% of insurers and InsurTechs said a focus on holistic risk solutions for customers was critical to establishing a future-state insurance marketplace.

- Data: More than 70% said advanced data management capabilities are critical.

- Partnerships: 90% of InsurTechs said partnerships were critical while 70% of incumbents said the same. Both insurers and InsurTechs have a hearty appetite for collaboration with other sectors, such as healthcare providers and players from the travel, transportation, and hospitality space (see Figure 5).

- Shared access: However, an emerging area in which views are evolving is the transition to a shared economy. Here, less than 40% of established insurers and InsurTechs say they consider shared ownership of assets to be critical.

Industry players should understand that the four shifts – focus on experience, data, partnership, and shared access – are interrelated and critical for partnering with other entities to develop bundled offerings. Concentrating on one at the expense of others may stymie the overall efficiency of the marketplace.

Digital maturity does not match aspiration

While insurers realize the importance of these fundamental shifts, there is a significant gap between their expectations and their current digital maturity. Lack of digital maturity is the biggest concern for incumbents. While 68% of insurers said they believe partnerships are critical, only 32% are currently collaborating with ecosystem partners (see Figure 6).

Less than 40% of insurers have a holistic digital transformation strategy and are collaborating with ecosystem players to provide value-added services. Only 11% of insurers say they leverage open architecture, which is critical for working with other industry players.

Experience-led digital offerings and seamless collaboration with ecosystem players will drive marketplace success

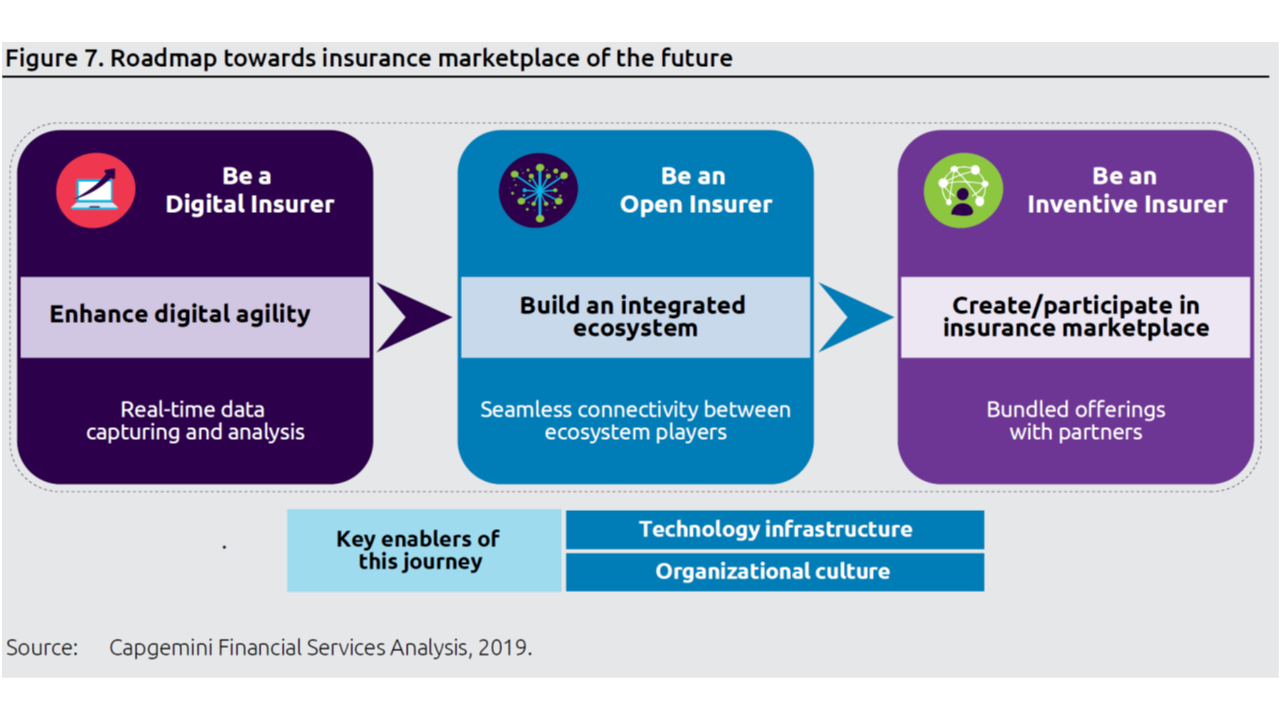

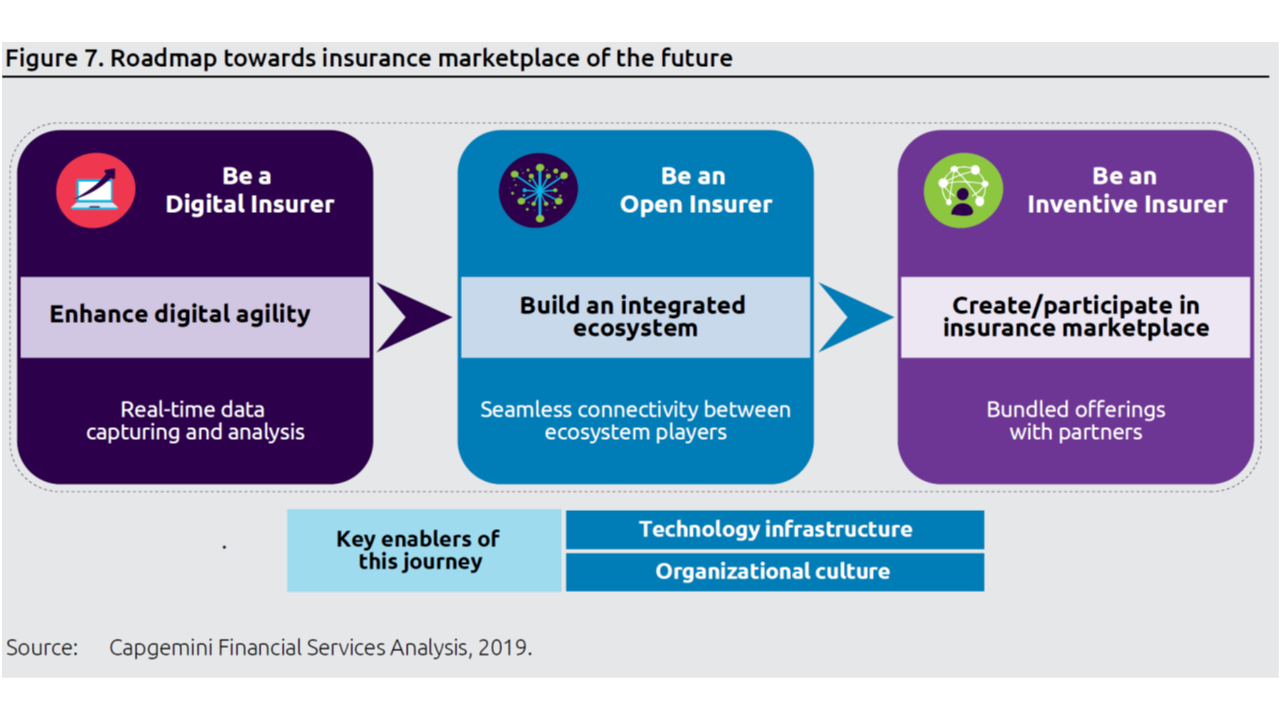

We call firms prepared to excel in the future marketplace Inventive Insurers because they have strategically updated their product portfolios, operating models, and distribution methods. They have outlined their distinctive capabilities as well as their competency gaps and are ready to deliver end-to-end solutions in the manner customers prefer.

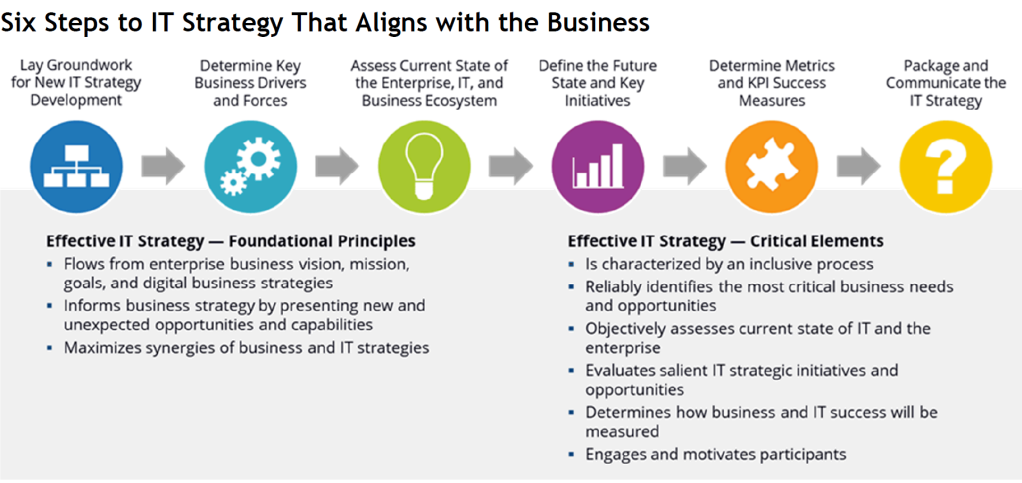

Pragmatic assessment (and subsequent enhancement) of a firm’s digital maturity is critical to connecting with ecosystem players seamlessly. Figure 7 shows the steps companies need to take to establish the marketplace of the future.

1. Prioritize digital agility

The critical first step in the future marketplace journey is boosting digital agility. The more quickly initiatives are implemented, the more quickly firms will enhance their digital maturity and actively participate within a connected ecosystem. Insurers must holistically adopt these critical capabilities to optimize their digital agility and seamlessly connect with partners to develop digitallyintegrated ecosystems (see Figure 8).

- Real-time data gathering

- Advanced analytics

- Re-engineering complex processes and automating them

2. Build an integrated ecosystem

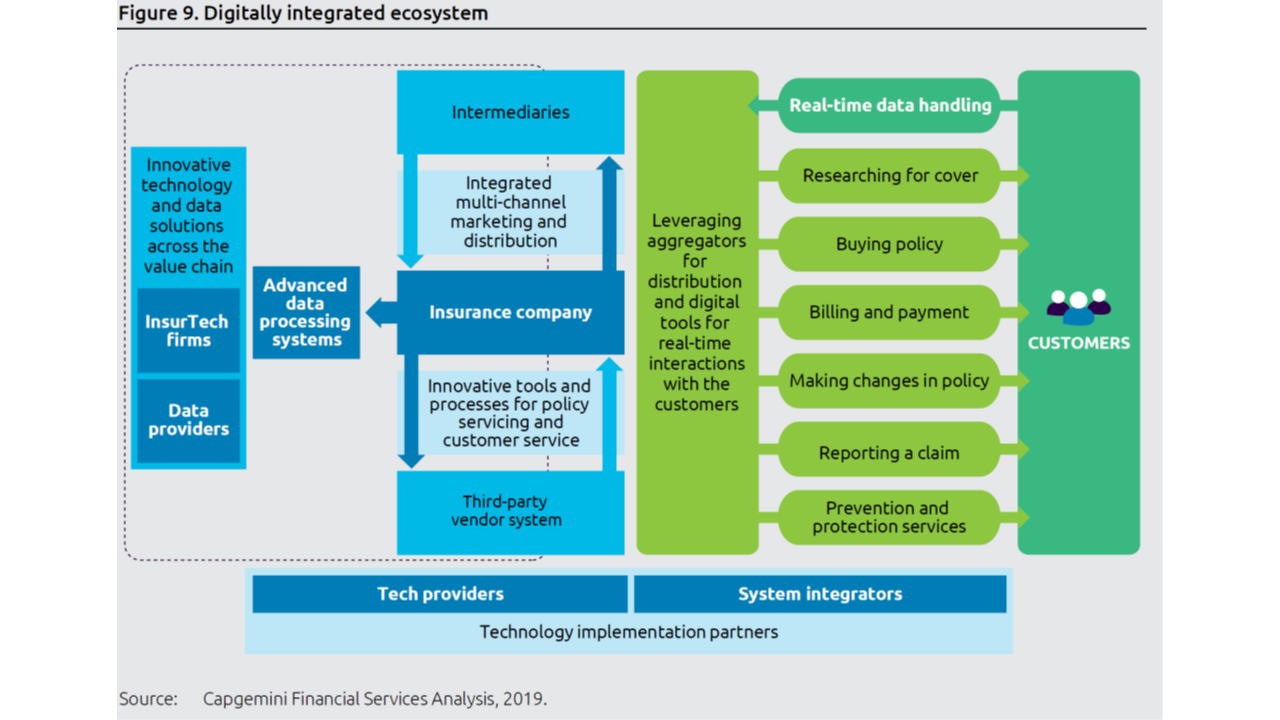

Seamless collaboration between insurers and their strategic partners is the backbone of a digitally integrated ecosystem. As new players enter the insurance value chain (aggregators, original equipment manufacturers (OEMs), one-stop policy management apps, and third parties such as repair stores), incumbents must strengthen their position through strategic partnerships.

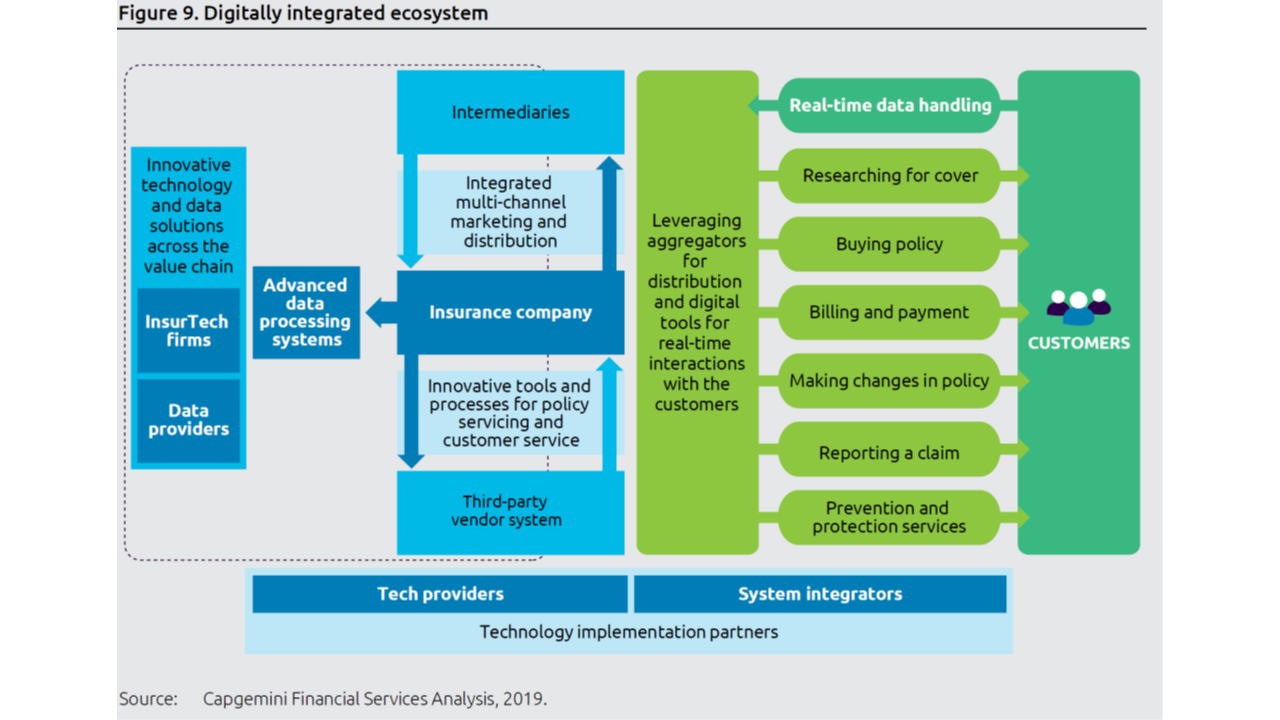

Our proposed digitally-integrated ecosystem seamlessly interconnects insurers with customers and partners to enable the efficient flow of information and services (see Figure 9).

In the digitally-integrated ecosystem, customers can access insurers over various channels through extended multi-device, multi-platform, and mobility offerings. Digital integration with partners will play a crucial role as insurers seek to increase their reach and provide customers with convenient and seamless services.

Integration with aggregators and intermediaries offers insurers a choice of distribution channels. As insurers connect with individual customers through devices, real-time data can be captured and used to provide personalized offerings and value-added services.

Insurers will move beyond traditional touchpoints to become their customers’ constant risk control advisory and partner. For that to happen, however, insurers will need to join forces with third-party vendors for efficient claims management and payout, and with OEMs for real-time customer data.

APIs, cloud-based storage, and blockchain can foster insurance ecosystem integration by enabling the seamless and secure transfer of data between diverse systems. A digitally-integrated ecosystem – both within and outside the organization – will support the real-time, personalized services that customers already demand. Digital mastery can benefit top- and bottom lines and propel insurers forward.

Grasping the art of teamwork with close ecosystem players – and relevant offerings based on core capabilities – will lay the groundwork for insurers to partner profitably.

3. Create tomorrow’s marketplace

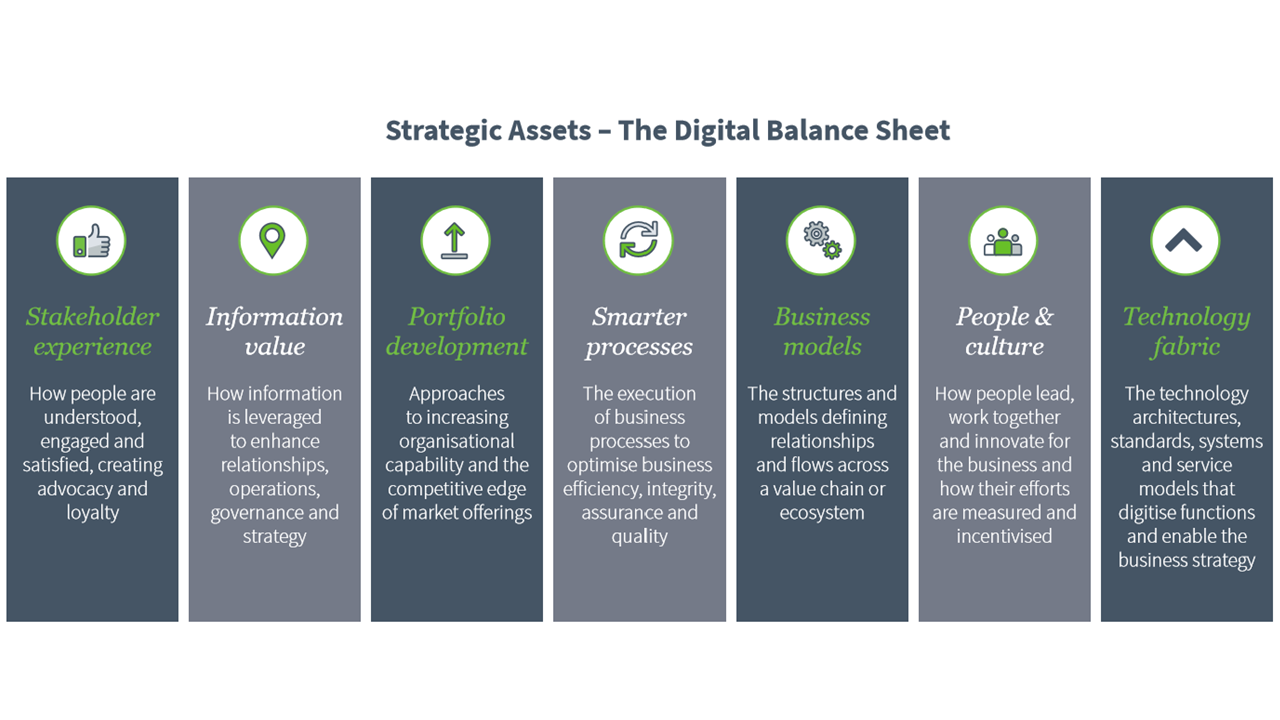

Firms must develop Inventive Insurer competencies to contribute to the successful development of tomorrow’s marketplace. These competencies include intelligent processes, open platforms, customer centricity, and an innovative mindset among team members ( see Figure 10).

Intelligent insurer. Automation, analytics, and artificial intelligence can prioritize customer experience within all operations.

- Process efficiencies can support top-notch service with quick turnaround times.

- Analytical competencies help insurers understand customer needs and act swiftly.

- Robust digital governance provides monitoring and ensures compliance within today’s dynamic regulatory environment.

Open insurers leverage open platforms to build an ecosystem of partners through seamless collaboration with third parties and enable firms to participate in the value chain of third parties. Insurers with open platforms can access and integrate new data streams to cater to customers’ evolving needs, reaching them in the way they prefer via new distribution channels. Modern platform with open architecture for providing bouquet of offerings also allow firms to take a fail-fast approach to product development and innovate at a faster pace.

Deep customer competencies allow insurers to leverage data and channels for enhancing the customer experience across all touchpoints. Deep customer insights generated using advanced analytics and AI enable insurers to keep the customer at the center of all decisions.

Product agility is crucial for insurers to create new products at a faster pace and gain a competitive edge from an increased speed-to-market. Creative culture and ability to innovate at scale are critical components for achieving product agility. A creative culture

encourages novel thinking from employees and spurs openness to change.

Innovation labs and design thinking can encourage a fresh approach, especially within cultures that are hard-wired with conventional processes and culture.

Leadership support and vision are also critical. While Inventive Insurer status may be an aspirational future state, each firm’s journey is unique. An open platform used as a sandbox is an excellent place to begin developing new competencies and learning how to innovate at scale. Inventive Insurers create digital, experience-led offerings by collaborating seamlessly with other ecosystem players.

Incumbents and InsurTechs will benefit from strategic collaboration

For the most part, the industry sees InsurTech collaboration only as a means to drive growth and transform the customer experience. For example, 84% of insurers and 80% of InsurTechs say they are focusing on “developing new offerings.”

However, when it comes to the critical building blocks for the new insurance marketplace – such as developing holistic technology infrastructure and advanced data management capabilities – there are significant gaps in the expectations of insurers and InsurTechs. For example, fewer than 40% of incumbent insurers want to build holistic technology infrastructure by collaborating with InsurTech firms, while more than 60% of InsurTechs wish to work with insurers to create such a foundation.

What’s more, while data security remains a crucial concern when establishing partnerships with other industries, only around 10% of incumbents and 25% of InsurTechs say they want to focus collaborative efforts on data security.

Industry players should focus on a holistic approach while venturing into an insurer-InsurTech collaboration to prepare for the future and consider tactical plans for quick wins that may offer short-term benefits.

External partners can facilitate incumbent-InsurTech collaboration

After clearly outlining collaboration objectives, insurers must select a partner. The World InsurTech Report 2018 took a deep dive into the InsurTech landscape and offered ways in which incumbents can assess the success potential of short-to-medium term partnerships with InsurTech firms as well as longterm relationship feasibility. Finding a partner that can address technology capability gaps may require specialized third-party support.

Incumbents and InsurTechs can optimize their structured collaborative efforts by keeping four guiding pillars in mind: People, Finance, Business, and Technology (Figure 13).

People (The right individuals in the best-fit positions): Employees are a firm’s most essential assets when it comes to driving innovation, growth, expansion, and fruitful collaboration. Both partnering entities must be flexible and strive for a balance between the hierarchical nature of many traditional insurers and the flat organizational structure favored by InsurTechs.

Finance (Allocate optimal capital, realistically forecast returns): Without a defined investment and revenue model, it may be difficult to articulate a compelling value proposition. Participants need adequate capital to invest in the partnership and a proven revenue generating model to maintain positive cash flow in the not-too-distant future.

Business (Early traction, measurable success): Business traction, a proven business model, customer adoption, and value creation are must-meet goals for any potential collaboration. A new business model should solve the needs and challenges that were difficult to tackle independently. A collaborative partnership should produce a value proposition with quantifiable results.

Technology (Collaboration tools and technologies): Technology tools should be secure and enable frictionless collaboration, as well as scalability. Partner systems should securely integrate with the help of technology. Accessed information must be accurate, timely, and be regulatorily compliant. It should be scalable without affecting current systems.

New ecosystem roles will evolve as the industry transitions toward the marketplace model

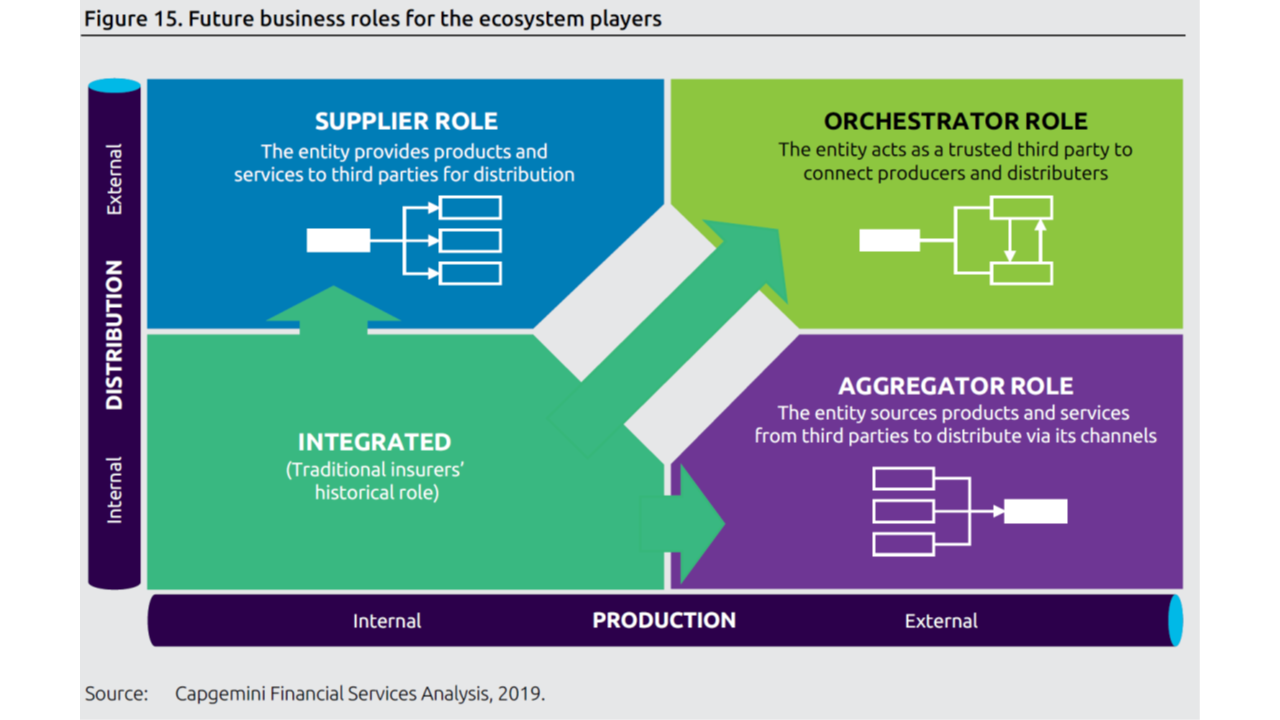

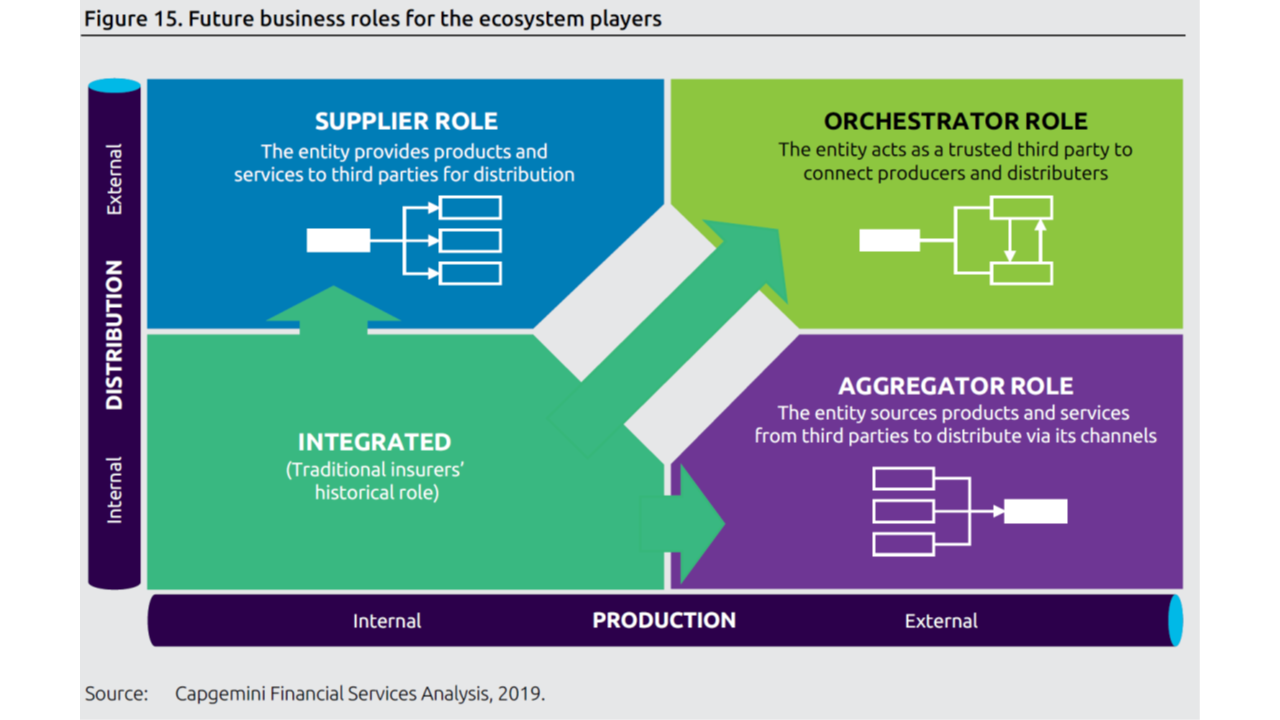

As the insurance industry advances, new specialist roles are developing. In addition to the traditional integrated business role, new functions include that of Supplier, Aggregator, and Orchestrator. Close collaboration will enable incumbents and InsurTechs to maximize opportunities in each.

These roles are not business-model exclusive but business-case specific. Each ecosystem entity may mix and match positions depending on the business model in play (see Figure 15).

Established insurers and InsurTechs can also play multiple roles within an ecosystem. For example, a firm can act as both supplier and orchestrator. Similarly, one firm may be a supplier in an ecosystem, but be an orchestrator in another ecosystem.

Click here to access Cap Gemini’s entire report