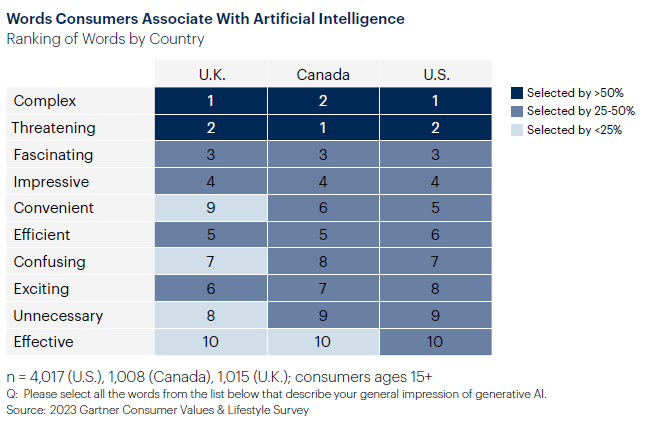

Consumers have more ways than ever to communicate with the brands they buy — be it through private chat or in public on social media sites such as Twitter. If a conversation conveys a negative sentiment, it can be detrimental if it’s not addressed quickly. Many companies are leaning on early stage AI tools for help.

Companies can use artificial intelligence in customer service to build a brand that’s associated with excellent customer experience (CX). This is critically important in an era in which consumers can easily compare product prices on the web, said Gene Alvarez, a Gartner managing VP, during a September 2018 webinar in which analysts discussed ways artificial intelligence in customer service can drive business growth. « When your price is equal, what’s left? Your customer experience, » Alvarez said. « If you deliver a poor customer experience, they’ll go with the company that delivers a good one. This has created a challenge for organizations trying to take on the behemoths who are doing well with customer experience, with the challenge being scale. »

AI in customer service enables companies to understand what their customers are doing today and to quickly scale CX strategies in response. Chatbots can be deployed relatively quickly to handle customer requests around the clock, while social listening tools can track customer sentiment online to gain insight, identify potential new customers, and take proactive action to protect and grow brands.

With that, AI technologies including text analytics, sentiment analysis, speech analytics and natural language processing all play an increasingly important role in customer experience management. By 2021, 15% of all customer service interactions will be handled by AI — that’s 400% higher than in 2017, according to Gartner.

Where AI for customer service makes sense

With the current hype around AI, companies may rush into projects without thinking about how artificial intelligence can help execute their vision for customer experience — if it’s appropriate at all, Alvarez said.

« Organizations have to ask the question, ‘How will I use AI to build the next component of my vision in terms of execution from a strategy perspective?‘ [and] not just try AI at scattershot approaches, » he said. « Look for moments of truth in the customer experience and say, ‘This is a good place to try [AI] because it aligns with our vision and strategy and the type of customer experience we want to deliver.' »

For example, an extraordinary number of companies have deployed chatbots or virtual assistants or are in the process of deploying them. Twenty-five percent of customer service and support operations will integrate bot technology across their engagement channels by 2020, up from less than 2% in 2017, Gartner reported.

But chatbots certainly aren’t the right choice for all companies. Customers who shop a luxury brand may expect a higher level of personalized customer service; self-service models and chatbots aren’t appropriate for customers who expect their calls to be answered by a person, Alvarez said.

And it’s no secret that virtual agents haven’t delivered the success companies hoped for with AI in customer service, said Brian Manusama, Gartner research director, in the webinar. All the experimentation with chatbots and virtual agents has, in some cases, hurt the customer experience instead of contributing to it. Companies have a long way to go to learn which technologies to use for the right use cases, he said.

« Companies really getting into [AI for CX] are disproportionally getting rewarded for it while companies that don’t do well with it are getting disproportionally punished for it, » Manusama said.

Match the product to the CX

The first step in choosing software for artificial intelligence in customer service is to understand that there is no single tool that works for every customer in every scenario, said Whit Andrews, an analyst at Gartner. For example, a customer who buys an inexpensive product may be fine interacting with a chatbot about that purchase, but not other types of purchases, he said.

« You have to identify the people who want to work with a chatbot and be realistic about the fact that if someone says they’d rather work with a chatbot, they might mean that for one situation but not another, » Andrews said.

To put a finer point on it, Jessica Ekholm, a Gartner research VP, advised companies to « pick the right battles » with AI tools by examining where the customer pain points are and developing a CX strategy that uses artificial intelligence in customer service strategically.

Cohesive AI in CRM strategies requires a singular 360 view

AI in CRM today is like mobile in the 1990s and social media channels in the 2000s, according to Jeff Nicholson, vice president of CRM product marketing at Pegasystems: It seems everyone wants a piece of the pie.

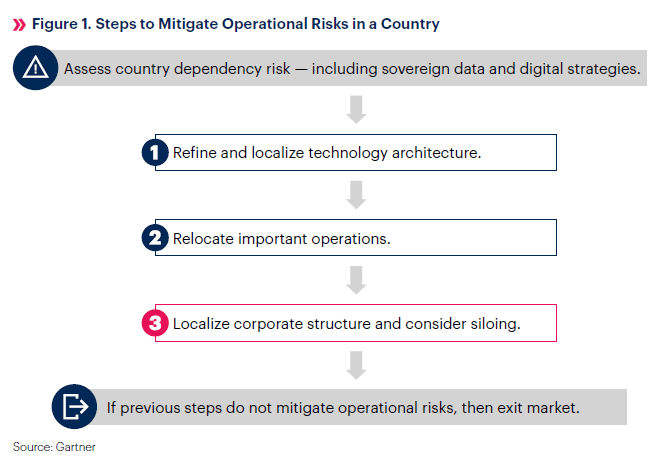

« Companies are anxious to deploy AI, so they try a little over here, maybe a little over there, just to keep up, » Nicholson said. « Before you know it, you’ve created another stack of silos across the enterprise. » To succeed with AI in CRM, he explained, organizations need a holistic strategy that ties AI across all departments and customer-facing channels. Using a channel-less approach, companies can avoid a disjointed user experience and very frustrated customers and instead take advantage of the full power of their data.

At the center of an experience platform where the AI brain lives, businesses should react in real time with chatbots, mobile apps, webpages, on the phone or in person at the store, Nicholson said. « This singular AI brain approach, » he noted, « allows [companies] to extend predictive intelligence to all other channels, without having to start from scratch for each new interface that comes along. »

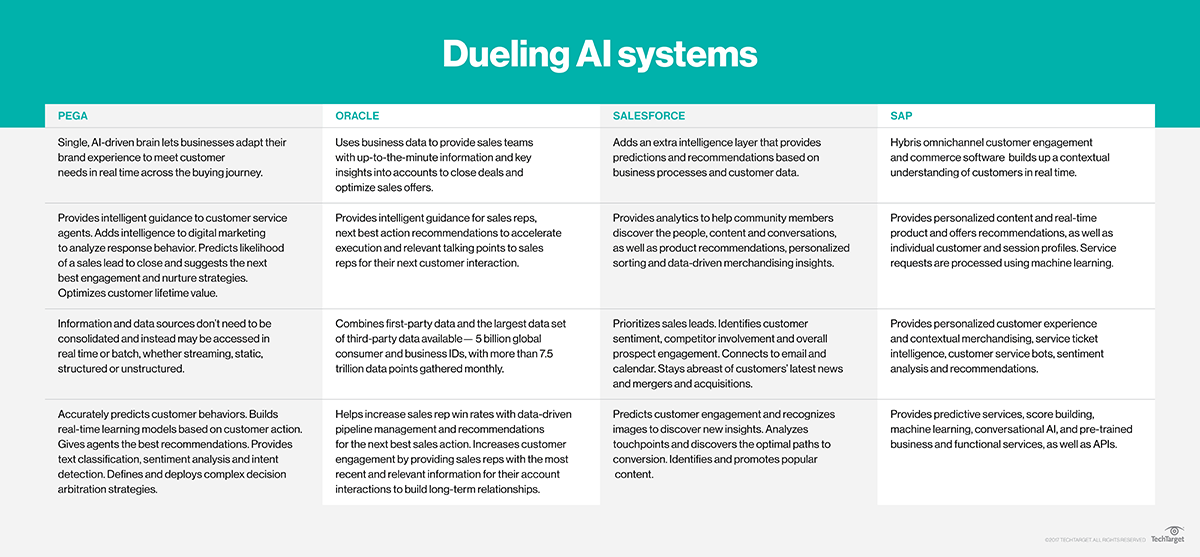

Pega is ahead of the curve, he claimed, with the Customer Decision Hub, which serves as the central AI brain across all its CRM applications — from marketing to sales to customer service. « We’ve seen our clients leverage it to redefine how they engage with customers to turn their businesses around, » he reported, citing two examples: Royal Bank of Scotland raised its Net Promoter Score by 18 points across its 17 million customers, while Sprint overcame industry-high turnover rates and realized a 14% increase in customer retention.

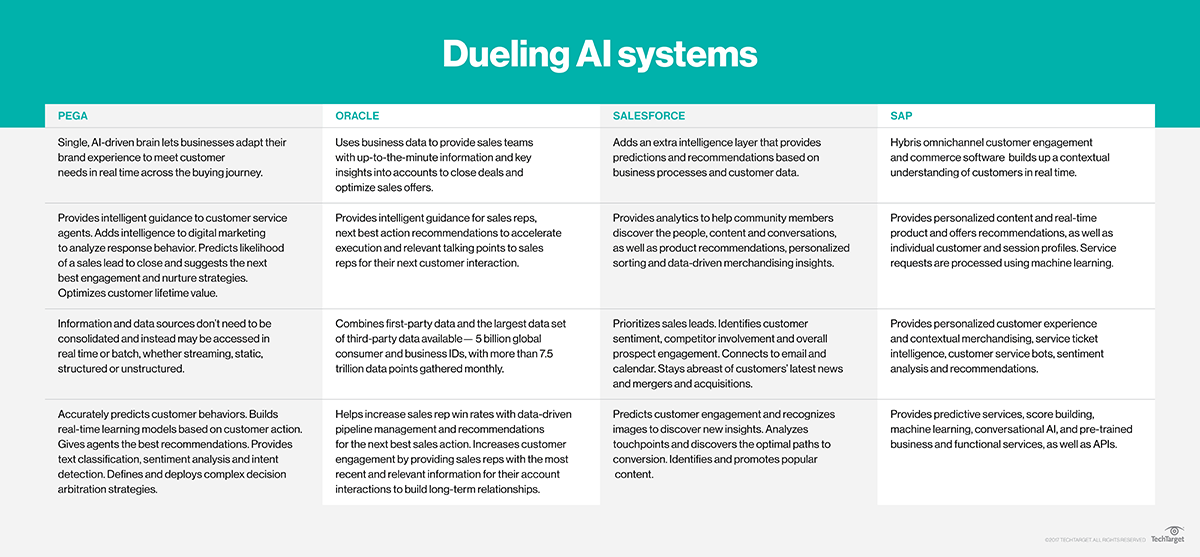

SAP‘s Leonardo AI and machine learning tool can help companies with their digital transformation and customer engagement strategies. It also helps organizations address key technologies, including machine learning, internet of things, blockchain, big data and analytics. SAP Hybris follows an organic development approach to AI in CRM, using data scientists and development teams across all areas of the business. Find out more about Pega, Oracle, Salesforce and SAP AI systems in the following chart:

AI strategy comes first, then AI tools second

For all the talk and focus on technological innovations that have disrupted and changed business processes, what has really changed the most during the technology revolution of the last 20 years is the customer.

Customers enter the buying process equipped with more information and perspective than ever before. From a bygone era of personal experiences and finite wells of word-of-mouth reviews, customers are now engaged with millions of other customer experiences through social media and online reviews, as well as unlimited resources, when making product or service comparisons. This paradigm shift has left marketers, sellers and service teams playing catch-up to develop strategies combined with technology to better equip themselves and capitalize on the customer’s experience.

Companies and brands hope that infusing a CRM AI strategy within their business will help balance the scales when interacting with customers. No business wants to enter a negotiation knowing less than its counterpart. And based on the marketing churn of most software companies, it’s easy to assume that many businesses have already implemented AI into their marketing and sales processes, and those that haven’t will be left in the dust.

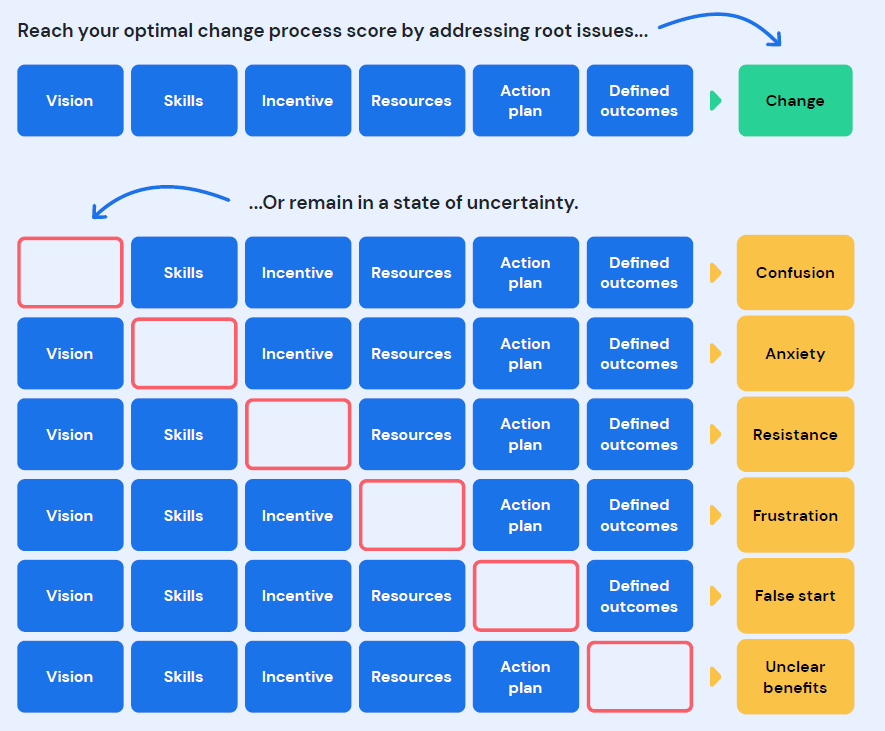

« If the AI-driven environment can learn enough and be trained correctly, it can deliver better customers that are more relevant and timely and on the right device and right promotion, » Forrester Research principal analyst Joe Stanhope said. But AI in customer experience comes with a caveat. « It will play out as a multiyear process, and it’s not necessarily a technology problem, » Stanhope warned. « It’s more of a change of management and a cultural issue. »

Delivering on customer expectations

The importance of implementing an AI strategy into the customer experience isn’t lost on business executives. According to Bluewolf’s latest « State of Salesforce » annual report, 63% of C-level executives are counting on AI to improve the customer experience. A 2017 IBM study also indicated that 26% of respondents expect AI to have a significant impact on customer experience today, while 47% expect the impact to be within the next two or three years.

Chief marketing officers set sights on CRM AI

In the next two to three years, one-third of organizations plan to implement AI technologies, according to a 2017 study conducted by the IBM Institute for Business Value. Yet some organizations surveyed have already implemented AI technologies and intend to license more.

IBM‘s « Cognitive Catalysts: Reinventing Enterprises and Experiences With Artificial Intelligence » divided chief marketing officers into three groups of respondents:

- Reinventors are AI-enabled with significant future investment,

- Tacticians are AI-enabled with minimal future investment

- and Aspirationals are planning their first AI-enabled investment.

In the next two years, 63% of reinventors, 48% of tacticians and 70% of aspirationals plan to implement AI technologies to help reinvent the customer experience, demonstrating that an AI implementation needs to start at the executive level and work its way down to the user base.

By then, there should be a substantial increase in use cases for AI customer service — not just in the product servicing sense, but also in the marketing and sales stages of the customer experience. « Buyers expect something different these days; they come in much more educated, » said Dana Hamerschlag, chief product officer at sales consultancy Miller Heiman Group. « The trick and challenge around AI is how do you leverage this powerful machine to tell you that process, rather than just give you the outcome data. »

The significance of gaining an edge on the customer extends to marketing, too, with a CRM AI strategy that can solve prospecting concerns. According to the Bluewolf’s annual report, 33% of marketing organizations that are increasing AI capabilities within the next year expect the technology to have the greatest impact on the ability to qualify prospects. « You need to enter a conversation with a customer understanding their context, » Hamerschlag advised. « You need to be informed and, with AI, not only [of] who they are but what they have looked at, what they are reading on my site, what emails they have opened. »

Technology based on strategy

The emphasis on customer experience has provided an outlet for AI’s potential. Companies are beginning to explore ways that a CRM AI strategy and the subsequent technologies can help improve customer service and experience.

Personalized photo books company Chatbooks Inc. helps customers convert photos on their phone or tablet into physical photo albums. It uses customer service reps to help customers complete the process and started implementing chatbots to streamline the customer service process. « It’s important that the customer service team is there when customers need them, » said Angel Brockbank, director of customer experience at Chatbooks, based in Provo, Utah.

The initial chatbot established by Chatbooks, created using Helpshift, a San Francisco-based customer service platform, helps customers create an account and input basic information like name and email. Brockbank said the company has an AI strategy in place and will be implementing another chatbot to help direct customer inquiries to the correct chat agent. « We haven’t done that yet, » she acknowledged, « but it will be helpful and useful for our team. »

This blending of product and experience has created an important need for AI technologies, according to Mika Yamamoto, chief digital marketing officer at SAP. « The technology is only as good as the strategy that goes with it, » Yamamoto said. « Companies have to understand how they want to show up for their customers and what type of customer engagement or experience they’re trying to enable. »

One of the impediments to implementing AI is employee adoption, according to a recent Forrester survey. Among CRM professionals, 28% said that one of the largest challenges to improving CRM last year was gaining user acceptance of new technologies, compared to 20% in 2015, a 40% increase. However, the CRM professionals thought it was easier working with IT to adopt new technologies last year (19%) than it was in 2015 (31%), a near 40% drop.

Still, the increased importance of the customer experience and knowing the customer is the main objective driving an AI strategy and the departmental changes that requires. In the Forrester survey, 64% of CRM professionals said creating a single view of customer data and information is the largest challenge they face when improving CRM capabilities, up from 47% in 2015.

Click here to access TechTarget’s publication