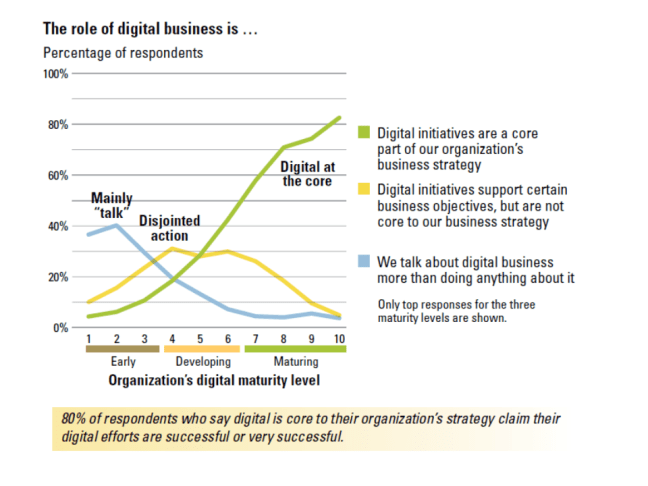

Digitization is a long way from running out of steam, since the bulk of company revenues in most industries still come from traditional sources. Yet the results from McKinsey’s latest survey on digital strategy suggest that a digital divide is already taking shape. Companies competing in traditional ways (that is, without applying digital technologies and strategies in their businesses) have seen lower rates of revenue and earnings growth than have companies competing in digital ways—and those rates are tightly correlated with the level of digitalization, or digitization, in their respective sectors. But other players are seeing tremendous growth as digitization advances. The companies making digital moves—digital natives, industry incumbents competing in new and digital ways, and incumbents moving into new sectors—are out-performing their traditional-incumbent counterparts.

We call these companies digital reinventors. While most respondents say that their companies are making at least marginal investments in digital, we found last year that few had achieved top-quartile growth and high returns—not surprising, given the lukewarm response to digitization the average respondent reports in this year’s survey. Digital reinventors, in contrast, are embracing digital with both their investments and their strategic decision making. Our results indicate that companies in this group are not only investing more in digital but also investing and executing differently. The reinventors are investing at scale in

- technology,

- analytics,

- and digital talent

—not just playing on the margins—and investing much more aggressively in business-model innovations or entirely new business models. They make more digital-related acquisitions and divestitures than traditional incumbents do; they are likelier to accelerate changes in their own businesses; and they are using more advanced, innovative technologies. The results indicate that their efforts are paying off: the reinventors are seeing larger gains in revenues and earnings than are traditional incumbents that have yet to embrace digitization.

Growing pressure on incumbents

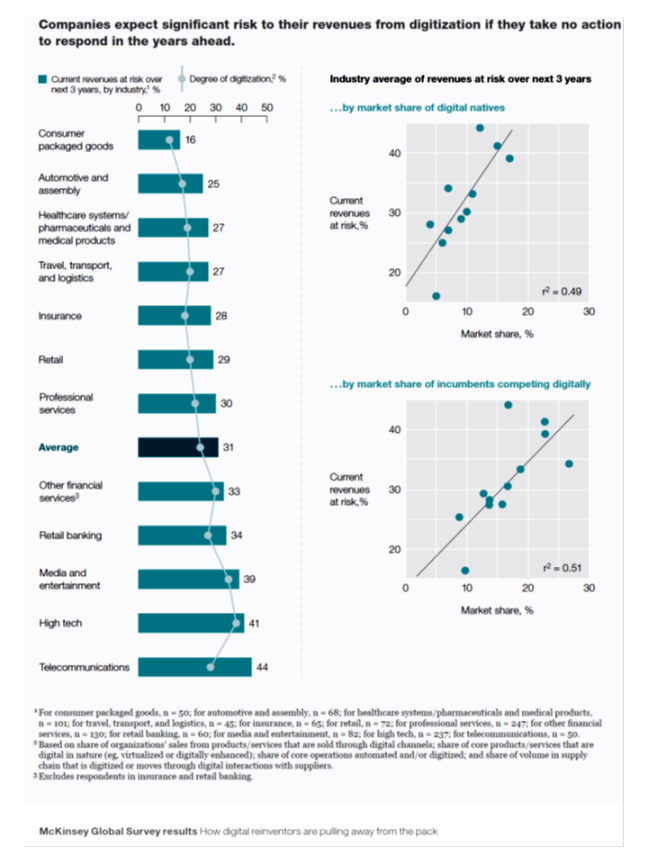

As digitization continues to progress, its expected effects on revenues seem pronounced. When respondents were asked how much of their companies’ revenues would be at risk in the next three years if those companies took no further action to address digital pressures, they estimated that almost one-third could be lost or cannibalized. Consistent with our earlier research showing that increased levels of digitization produce shrinking profit and revenue pools at the industry level, the revenues at risk are even greater in the industries (high tech, as well as media and entertainment) experiencing the highest levels of digitization.

But the level of digitization is only part of the industry picture. Despite a common belief that digital natives are the greatest threat to an industry’s existing market share, the results indicate that incumbents competing in digital ways pose just as great a threat to other companies, if not a greater one.

The correlation between the market share owned by digital natives and revenues at risk is on par with that of incumbents playing digitally. This finding is consistent with other work suggesting that incumbents can have a strong effect on the market and on the pace of digital disruption in a given industry, and this effect is only magnified by the more powerful positioning of these incumbents. Since those competing in digital ways already own a larger market share than digital natives do, on average, they can also make larger shifts in the economics of their respective markets.

To date, the loss of revenues as digitization has expanded is already clear. Nearly 20 percent of all respondents report negative revenue growth in the past three years. But some companies can thrive in a more digitized landscape: specifically, those trying to reinvent themselves by embedding digital technologies in the core of their business models and by launching new digital businesses. Respondents at incumbents playing digitally are twice as likely as traditional incumbents to report exceptional financial growth (that is, an average compound annual growth rate of more than 25 percent) during this same period.

Click here to access McKinsey’s detailed survey analysis