EIOPA identified potential divergences in the supervisory practices concerning the supervision of the SCR calculation of immaterial sub-modules.

EIOPA agrees that in case of immaterial SCR sub-modules the principle of proportionality applies regarding the supervisory review process, but considers it is important to guarantee supervisory convergence as divergent approaches could lead to supervisory arbitrage.

EIOPA is of the view that the consistent implementation of the proportionality principle is a key element to ensure supervisory convergence for the supervision of the SCR. For this purpose the following key areas should be considered:

Proportionate approach

Supervisory authorities may allow undertakings, when calculating the SCR at the individual undertaking level, to adopt a proportionate approach towards immaterial SCR sub-modules, provided that the undertaking concerned is able to demonstrate to the satisfaction of the supervisory authorities that:

- the amount of the SCR sub-module is immaterial when compared with the total basic SCR (BSCR);

- applying a proportionate approach is justifiable taking into account the nature and complexity of the risk;

- the pattern of the SCR sub-module is stable over the last three years;

- such amount/pattern is consistent with the business model and the business strategy for the following years; and

- undertakings have in place a risk management system and processes to monitor any evolution of the risk, either triggered by internal sources or by an external source that could affect the materiality of a certain submodule.

This approach should not be used when calculating SCR at group level.

An SCR sub-module should be considered immaterial for the purposes of the SCR calculation when its amount is not relevant for the decision-making process or the judgement of the undertaking itself or the supervisory authorities. Following this principle, even if materiality needs to be assessed on a case-by-case basis, EIOPA recommends that materiality is assessed considering the weight of the sub-modules in the total BSCR and

- that each sub-module subject to this approach should not represent more than 5% of the BSCR

- or all sub-modules should not represent more than 10% of the BSCR.

For immaterial SCR sub-modules supervisory authorities may allow undertakings not to perform a full recalculation of such a sub-module on a yearly basis taking into consideration the complexity and burden that such a calculation would represent when compared to the result of the calculation.

Prudent calculation

For the sub-modules identified as immaterial, a calculation of the SCR submodule using inputs prudently estimated and leading to prudent outcomes should be performed at the time of the decision to adopt a proportionate approach. Such calculation should be subject to the consent of the supervisory authority.

The result of such a calculation may then be used in principle for the next three years, after which a full calculation using inputs prudently estimated is required so that the immateriality of the sub-module and the risk-based and proportionate approach is re-assessed.

During the three-year period the key function holder of the actuarial function should express an opinion to the administrative, management or supervisory body of the undertaking on the outcome of immaterial sub-module used for calculating SCR.

Risk management system and ORSA

Such a system should be proportionate to the risks at stake while ensuring a proper monitoring of any evolution of the risk, either triggered by internal sources such as a change in the business model or business strategy or by an external source such as an exceptional event that could affect the materiality of a certain sub-module.

Such a monitoring should include the setting of qualitative and quantitative early warning indicators (EWI), to be defined by the undertaking and embedded in the ORSA processes.

Supervisory reporting and public disclosure

Undertakings should include information on the risk management system in the ORSA Report. Undertakings should include structured information on the sub-modules for which a proportionate approach is applied in the Regular Supervisory Reporting and in the Solvency and Financial Condition Report (SFCR), under the section “E.2 Capital Management – Solvency Capital Requirement and Minimum Capital Requirement”.

Supervisory review process

The approach should be implemented in the context of on-going supervisory dialogue, meaning that the supervisory authority should be satisfied and agree with the approach taken and be kept informed in case of any material change. Supervisory authorities should inform the undertakings in case there is any concern with the approach. In case the supervisory authority has any concern the approach should not be implemented or might be implemented with additional safeguards as agreed between the supervisory authority and the undertaking.

In some situations supervisory authorities may require a full calculation following the requirements of the Delegated Regulation and using inputs prudently estimated.

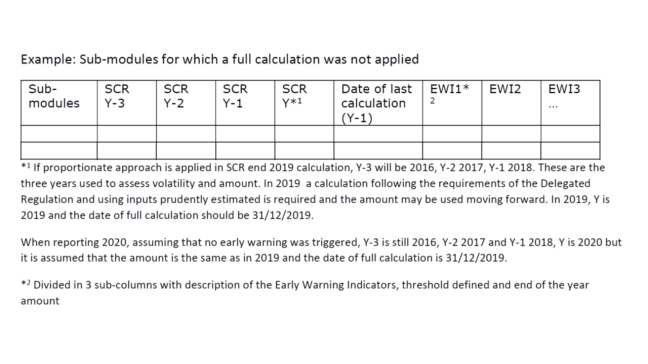

Example : Supervisory reporting and public disclosure

Undertakings should include information on the risk management system referred to in the previous paragraphs in the ORSA Report.

Undertakings should include structured information on the sub-modules for which a proportionate approach is applied in the Regular Supervisory Reporting, under the section “E.2 Capital Management – Solvency Capital Requirement and Minimum Capital Requirement” (RSR), including at least the following information:

- identification of the sub-module(s) for which a proportionate approach was applied;

- amount of the SCR for such a sub-module in the last three years before the application of proportionate approach, including the current year;

- the date of the last calculation performed following the requirements of the Delegated Regulation using inputs prudently estimated; and

- early warning indicators identified and triggers for a calculation following the requirements of the Delegated Regulation and using inputs prudently estimated.

Undertakings should also include structured information on the sub-modules for which a proportionate approach is applied in the Solvency and Financial Condition Report, under the section “E.2 Capital Management – Solvency Capital Requirement and Minimum Capital Requirement” (SFCR), including at least the identification of the submodule(s) for which a proportionate calculation was applied.

An example of structured information to be included in the regular supervisory report in line with Article 311(6) of the Delegated Regulation is as follows:

This proportionate approach should also be reflected in the quantitative reporting templates to be submitted. In this case the templates would reflect the amounts used for the last full calculation performed.

Click here to access EIOPA’s Supervisory Statement